Bill to spur clean energy investment brought back in Senate

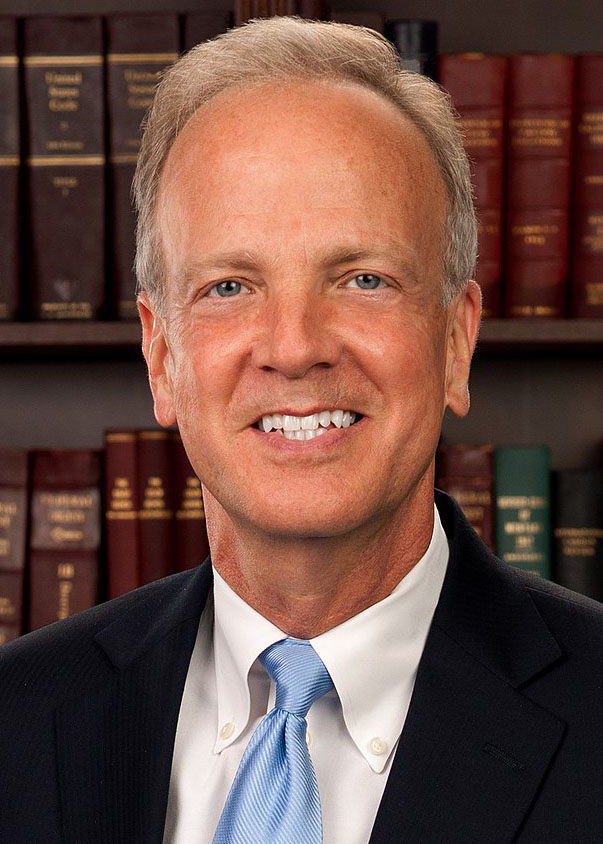

Moran

Coons

Sens. Chris Coons (D., Del.) and Jerry Moran (R., Kan.) late last month reintroduced legislation to give investors in clean energy projects, including advanced nuclear, access to a tax advantage currently available only to fossil fuel investors. The bipartisan bill, the Financing Our Energy Future Act (H.B. 1034), was initially introduced in June 2019.

The measure would enable clean energy companies to form master limited partnerships (MLPs)—business ventures that combine the tax benefits of private partnerships (where profits are taxed only when investors receive distributions) with the liquidity of publicly traded companies. By statute, MLPs are currently available only to investors in energy portfolios for oil, natural gas, coal extraction, and pipeline projects.