Legislation introduced to extend production tax credits to nuclear

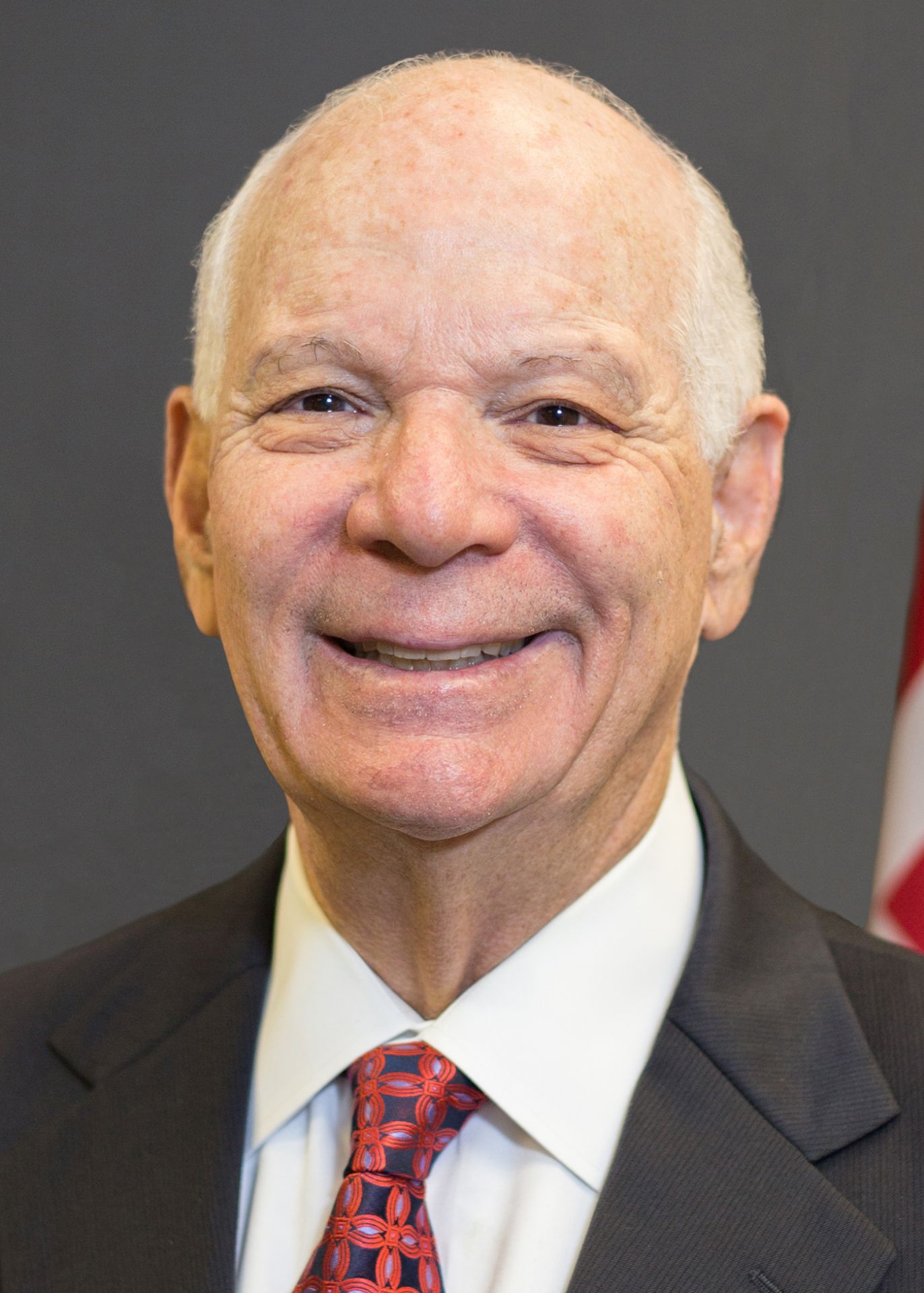

Cardin

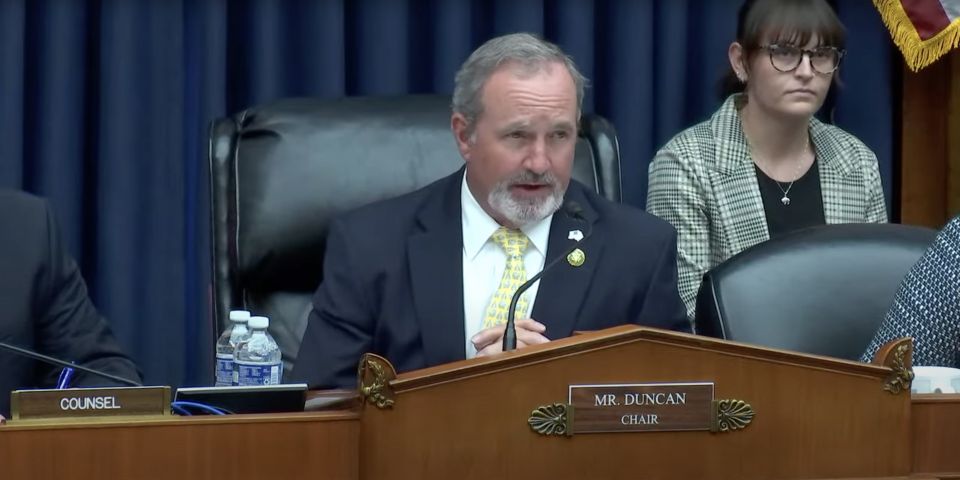

Pascrell

Companion bills that call for amending the Internal Revenue Code to establish a tax credit to help existing merchant nuclear plants continue operations debuted on Capitol Hill last week.

In the House on June 21, Rep. Bill Pascrell (D., N.J.) introduced the bipartisan H.R. 4024, dubbed the Zero-Emission Nuclear Power Production Credit Act of 2021. Cosponsors of the legislation include Reps. Brian Fitzpatrick (R., Pa.), Tom Suozzi (D., N.Y.), John Katko (R., N.Y.), Danny Davis (D., Ill.), Anthony Brown (D., Md.), Dutch Ruppersberger (D., Md.), Cheri Bustos (D., Ill.), Mike Doyle (D., Pa.), and Bobby Rush (D., Ill.).

And on June 24, Sen. Ben Cardin (D., Md.) introduced the Senate’s version, S. 2291, with Sens. Joe Manchin (D., W.Va.), Tom Carper (D., Del.), Sheldon Whitehouse (D., R.I.), and Cory Booker (D., N.J.) joining as cosponsors.