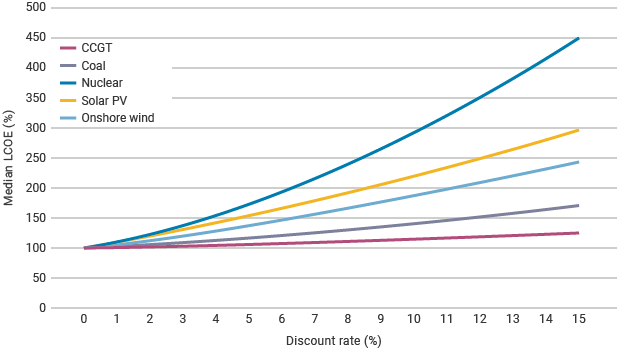

Interest rates have an outsized impact on nuclear power costs compared to those for other methods of power generation. (Source: World Nuclear Association)

In an essay titled “How the Fed will Strangle New Nukes,” published this week by American Thinker, nuclear engineer and writer Joseph Somsel warns that despite current expectations of a nuclear construction boom, “As in the late 1970s, rising interest rates will put the kibosh on new nukes.” Somsel therefore urges the financing and building of new nuclear facilities right now, before ongoing inflation and increasingly high interest rates “kill a lot of the plans” for new nuclear power plants.

History lesson: Somsel begins his essay by noting that high interest rates in the late 1970s and early 1980s led to the collapse of the nation’s ambitious nuclear construction program and the cancellation of many partially built plants. He states that nuclear power is more sensitive to interest rates than other energy sectors because it is highly capital intensive.

Commercial nuclear power had “kicked off in earnest in the late 1960s,” Somsel writes, when the Browns Ferry and Oyster Creek plants proved that they could justify their construction costs based on competitive electricity costs. By the early 1980s, 20 percent of U.S. electricity was being generated by nuclear energy. However, that’s also when the market turned against nuclear and most new construction stopped. Somsel presents a graph of interest rates on 30-year U.S. Treasury bonds, showing a peak in the early 1980s. He adds that rates on corporate bonds, such as those that utilities would use to finance nuclear plants, became even higher than Treasury bonds because they include a risk premium.

Economic explanation: “The cost of capital affects the cost of electricity,” Somsel explains. Despite low fuel costs, the capital-intensive nature of nuclear plant construction plays an outsized role in building plans: paying off high-interest bonds ends up being the major factor in nuclear plants’ electricity production costs. Somsel presents a graph from the World Nuclear Association illustrating how a nuclear plant’s cost of capital rises with interest rates more dramatically than for any other energy source.

Consequently, the 1970s nuclear construction activity came to a halt, and the 1980s saw “public and private utility companies with grossly weakened balance sheets, defaulted municipal bonds with angry bondholders, and a countryside littered with the empty husks of never-to-be-completed nuclear power plants,” Somsel writes.

Bad feelings: Today, given the geopolitical uncertainty and unreliability in the global energy market, Somsel suggests that many countries in Europe and elsewhere now wish they had more nuclear power plants up and running. He adds that previous negative feelings about nuclear energy are being replaced by “the more concrete bad feelings of too hot or too cold and maybe even the ache of a hungry belly.”

But despite the new attention being given to nuclear, that regret may only deepen as higher interest rates threaten to head off any nuclear new-build boom before it even begins.