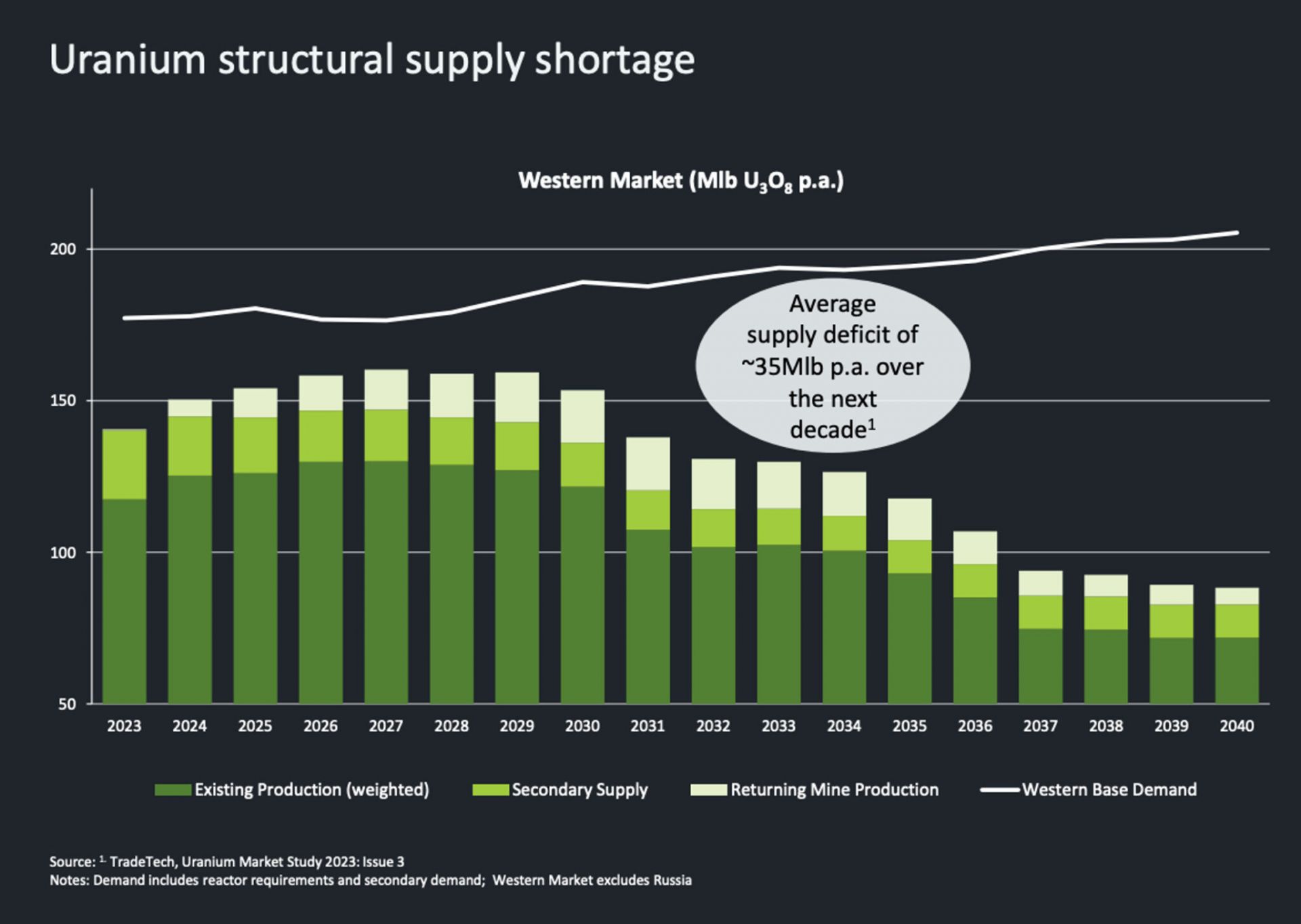

[Click to see full graphic] Western base demand (white line) for uranium will continue to outpace the combined existing production (dark green), secondary supply (middle green), and returning mine production (light green) through 2040, according to projections. (Image: Paladin Energy)

Investors continue to be bullish on uranium, according to a number of recent news reports. Stockhead recently trumpeted, “Uranium has started 2024 the same way it ended 2023—like a bull in a china shop. Spot prices are now agonizingly close to US$100/lb for the first time since 2008, with term pricing not far behind.” Similarly, Mining.com noted, “The spot price of uranium continues to rise, boosted by pledges to triple nuclear power by mid-century, supply hiccups from producers such as Cameco . . . , and the looming threat of a ban on Russian exports to the West.”

Supply and demand: A major factor behind the bullish outlook is that the demand for uranium in Western markets (excluding Russia)—currently at approximately 200 million pounds—is about 40 million pounds greater than the radioactive metal’s supply. Furthermore, market analysts project an average supply deficit of 35 million pounds per year over the next decade. That projection considers existing production, secondary supply, and returning mining production.

Ramping up production: Stockhead observed that a number of mining operations are ramping up their uranium production, including Boss Energy’s Honeymoon (in South Australia), Paladin Energy’s Langer Heinrich (in Namibia), and Cameco’s McArthur River project (in Saskatchewan, Canada). The latter company plans to increase its uranium production to 22 million pounds this year. However, to meet the market’s base demand out to 2040, much more production will be required from additional mining operations. Unfortunately, a new uranium mine can take as long as 15 years to come on line from discovery to first production, so meeting the demand will be difficult. Therefore, the “underlying market fundamentals are still ratcheting tighter,” according to Leigh Goehring, managing partner with natural resource investors Goehring & Rozencwajg Associates.

SPUT: Another factor behind the market is the Sprott Physical Uranium Trust (SPUT), which began buying uranium in 2021 to take the metal out of circulation and impound it for the long term. As of early 2024, SPUT had impounded more than 63 million pounds of uranium. Some people in the industry have proposed adding a “redemption feature” to SPUT, so that as much as 5 percent of the trust’s uranium inventory might be made available for sale once or twice a year—a proposal has generated some controversy.

Nuclear resurgence: Mining.com quoted John Ciampaglia of Sprott Asset Management, which operates SPUT, as attributing part of the bull market to a nuclear “resurgence given the growing momentum. Who would have thought that in just two years, public sentiment and government support would have shifted this strongly?” He added, “The industry will require significant capital investments to meet its ambitious expansion plans.”

The mining website also pointed out that the spot price of uranium, which hit $91 per pound during the first week of 2024, “could now be near a level that can sustain new mining projects as the globe increasingly looks to atomic power to help combat global warming.”