Vistra, Energy Harbor deal finally closes

Vistra this week completed its acquisition of Energy Harbor Corp., a move the company announced almost exactly a year ago with a $3.43 billion price tag.

The move expands Vistra’s integrated zero-carbon generation by about 4,000 megawatts and adds about 1 million customers to its retail electricity business. With the acquisition and all required regulatory reviews completed, Vistra becomes the second-largest competitive nuclear fleet in the United States.

The transaction, said Jim Burke, Vistra president and chief executive, “represents our commitment to leading a responsible transformation of the country’s energy supply to greener energy sources through the expansion of our zero-carbon generation portfolio while continuing to prioritize reliable and affordable electricity” for customers.

Vistra and Energy Harbor employ about 6,800 people across the country.

Combined assets: The combined company has a generation capacity of around 41,000MWe—enough energy to power 3.2 million homes. The fleet includes four nuclear facilities totaling 6,400 megawatts across the ERCOT and PJM markets:

- The 2-unit Beaver Valley plant in Pennsylvania.

- The single-unit Davis-Besse and Perry plants in Ohio.

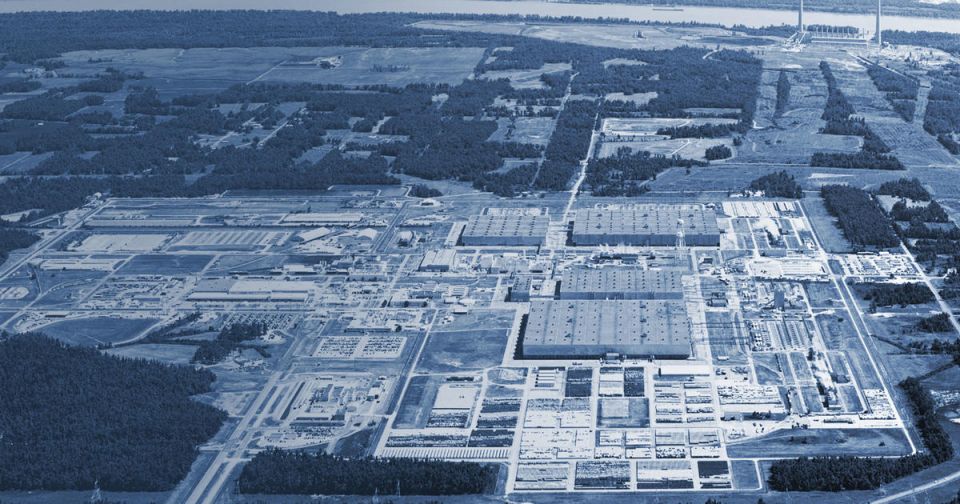

- Comanche Peak and its used fuel storage facilities in Texas.

It also owns the second-largest energy storage capacity in the country, at 1,020 MWe—including the world's largest battery energy storage facility—and a growing portfolio of solar assets, including some 340 MWe already on line.

The new subsidiary, Vistra Vision, will continue operate on an integrated basis with the company's dispatchable and reliable fossil fleet, now known as Vistra Tradition. The combined company's headquarters will be in Irving, Texas,

Overcoming hurdles: The Vistra–Energy Harbor acquisition raised concerns from the Department of Justice and the Federal Energy Regulatory Commission.

Figuring prominently in these concerns was PJM’s ATSI transmission zone—the only zone in which Vistra and Energy Harbor both owned generation assets. Included in ATSI are Energy Harbor’s Davis-Besse and Perry plants and Vistra’s gas- and oil-fired Richmond facility and oil-fired Stryker unit.

To alleviate concerns from regulatory agencies, Vistra divested itself of its Richland and Stryker facilities, saying, “These are the only generating facilities that could even arguably be considered as located in an overlapping ‘submarket’ in PJM with the Energy Harbor facilities.”

Following that move, the deal ultimately won DOJ and NRC approval. Vistra received its final nod of approval from the Federal Energy Regulatory Commission on February 19.

Quotable: "We remain focused on advancing our four strategic priorities of reliably serving our customers and communities through our integrated wholesale and retail business, consistently returning capital to our shareholders, maintaining our balance sheet strength, and supporting the clean-energy expansion,” Burke said. “This integration is the next chapter in Vistra's proud 140-year legacy of powering America, its people, and the economy, and it aligns squarely with our strategic priorities as we work toward a cleaner energy future while maintaining the strength and resilience of our nation’s electric grids.”