Eligible suppliers: BWXT Canada became the first company to join the supplier group, lending its expertise in the design, manufacture, and service of commercial nuclear components. BWXT Canada, a subsidiary of Virginia-based BWX Technologies, is in the process of expanding and investing in new equipment at its manufacturing facility in Cambridge, Ontario.

According to GEH, additional suppliers are eligible to join the group if they meet predefined criteria and customer requirements and demonstrate a willingness to invest in the supply chain capabilities for the BWRX-300.

Compact ESBWR: The design of the BWRX-300 SMR is based on the Generation III+ 1,520-MW economic simplified boiling water reactor (ESBWR), which the Nuclear Regulatory Commission certified in 2014. The BWRX-300 has a more compact configuration, with an electrical capacity of 300 MW, reduced need for concrete and steel, and an estimated construction time of only 24–36 months.

The BWRX-300, according to GE Vernova, “supports decarbonization efforts by delivering clean, always available power to the grid and behind-the-meter applications. In addition, it can provide hot water and steam that can be used for district heating, clean hydrogen and fuel production, reverse osmosis, and direct air capture.”

Market growth: The first BWRX-300 SMR is slated to be constructed at Ontario Power Generation’s Darlington New Nuclear Project site in Ontario, with commercial operation expected in 2029. In addition to OPG and GEH, included in the construction contract are AtkinsRéalis and Aecon Construction Group. The government of Ontario, together with OPG, is preparing plans for three additional BWRX-300s at Darlington. Two additional units may also be built in Saskatchewan.

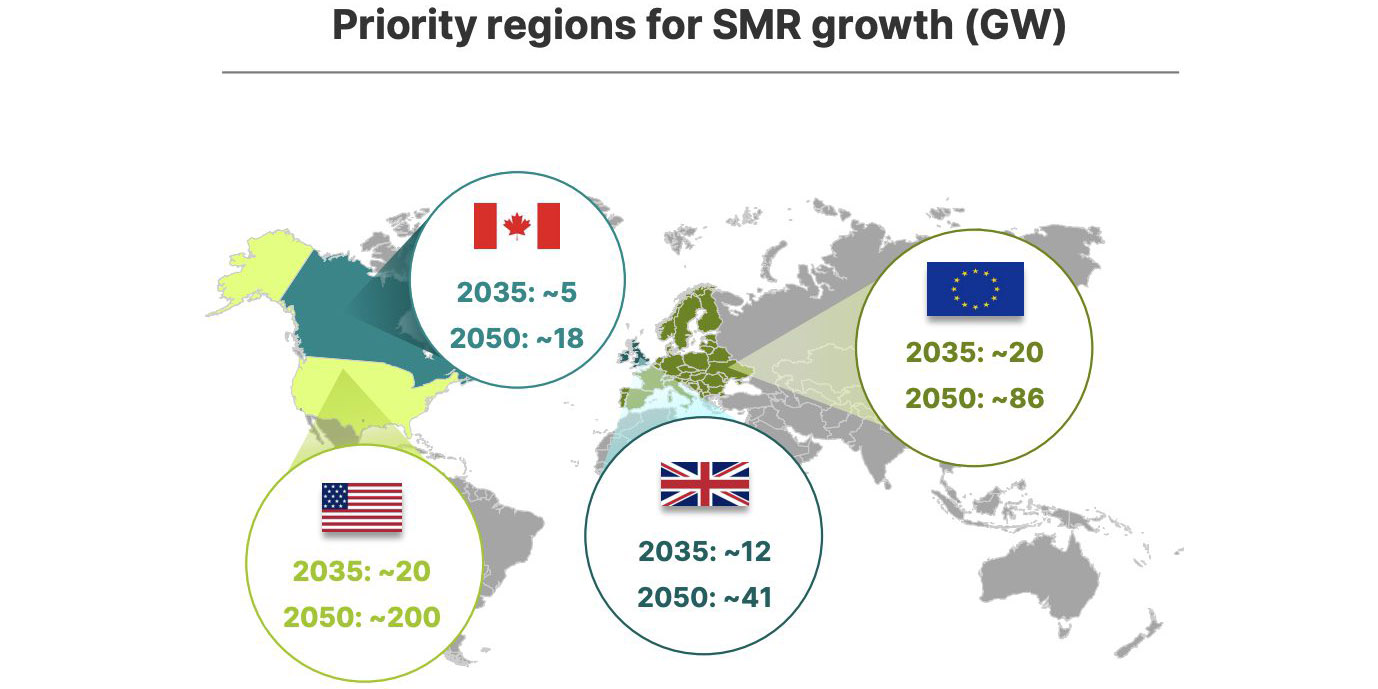

Processes are also underway to build BWRX-300s in the United Kingdom and Poland. In the United Kingdom, GEH has been awarded a Future Nuclear Enabling Fund grant to help advance regulatory acceptance of the SMR. In Poland, the government has agreed “in principle” to the eventual construction of 24 BWRX-300s at six sites.

GE Vernova has projected that demand for advanced nuclear plants may be evenly split between large reactors and SMRs, with “each accounting for around 375 GW by 2050.” The company believes that demand for large reactors will be led by emerging markets in China and India, whereas North America and Europe will favor SMRs because of their lower capital at risk, smaller footprint, and greater modularity.