Fuel cycle players signal next moves as Russian uranium ban becomes law

On May 13, President Biden signed the Prohibiting Russian Uranium Imports Act, unlocking the $2.72 billion that Congress conditionally appropriated in March to increase production of low-enriched uranium (LEU) and high-assay low-enriched uranium (HALEU).

From mining to enrichment, deconversion, and fabrication, the law could transform the front end of the nuclear fuel cycle, and not just in the United States. It’s the latest in a series of moves designed to reshape the global uranium market that will fuel a new generation of nuclear power plants. That includes the HALEU Availability Program, backed by $700 million for enrichment and deconversion contracts, and a U.S. collaboration with Canada, France, Japan, and the United Kingdom—a high-profile commitment to act together to sideline Russia in the global nuclear fuel market. For the uranium miners, enrichers, and customers who have been watching and waiting for policy changes, now is the time to act.

Not cold turkey: “President Biden signed into law a historic series of actions that will strengthen our nation’s energy and economic security by reducing—and ultimately eliminating—our reliance on Russia for civilian nuclear power,” National Security Advisor Jake Sullivan said May 13. “This new law reestablishes America’s leadership in the nuclear sector,” he said. Backed by the $2.72 billion appropriated in March, “it will jump-start new enrichment capacity in the United States and send a clear message to industry that we are committed to long-term growth in our nuclear sector.”

Sen. John Barrasso (R., Wyo.) introduced a bill to ban Russian uranium imports in March 2022, just one month after Russia’s invasion of Ukraine. When that bill didn’t move ahead, he and Sen. Joe Manchin (D., W.Va.) tried again in March 2023. Rep Cathy McMorris Rodgers (R., Wash.) introduced companion legislation, H.R. 1042, which passed the U.S. House of Representatives by voice vote in December 2023. That’s the bill the Senate passed by unanimous consent on April 30, and it complements the Nuclear Fuel Security Act passed this March as part of the National Defense Authorization Act.

As Nuclear News previously reported, the new law prohibiting unirradiated LEU produced in Russia will go into effect in 90 days, and it allows for short-term waivers through 2027—subject to specific annual limits—if “no alternative viable source of low-enriched uranium is available to sustain the continued operation of a nuclear reactor or a United States nuclear energy company” or if LEU imports from Russia are “in the national interest.” The ban is set to expire at the end of 2040.

According to a May 14 statement from Michael Goff, the acting assistant secretary for the U.S. Department of Energy’s Office of Nuclear Energy, “The Department of Energy estimates that U.S. utilities have roughly three years of LEU available through existing inventory or preexisting contracts.” Goff added that Russia currently has about 44 percent of the world’s enrichment capacity and supplies about 35 percent of U.S. imports.

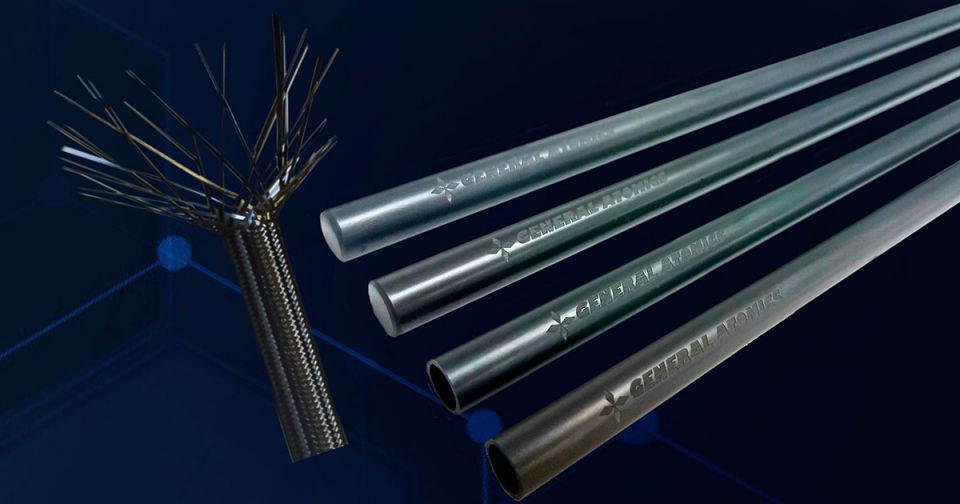

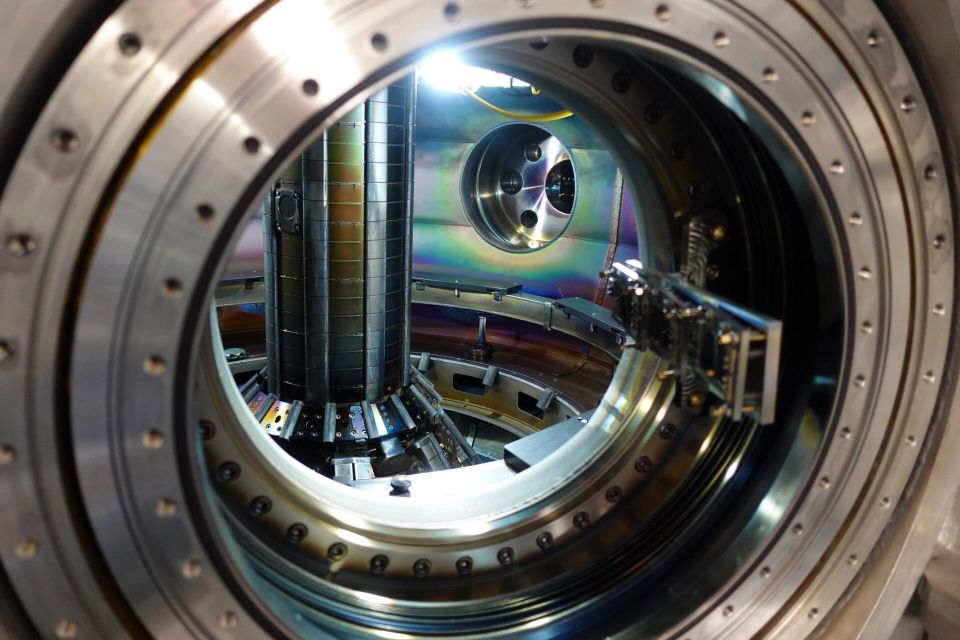

Enrichers: In the United States, only Urenco USA—a subsidiary of Urenco, which is owned by the Dutch, German, and U.K. governments—is currently producing LEU. U.S.-based Centrus Energy has been focused on meeting the terms of its HALEU demonstration contract with the DOE, while Global Laser Enrichment is accelerating a demonstration of laser technology, with a near-term focus on enriching uranium tails to natural-grade uranium.

Centrus needs a waiver: The uranium supplier and HALEU enricher reported a first quarter loss on May 7, but president and chief executive officer Amir Vexler said Centrus welcomes “the progress we are making to reclaim American leadership in uranium enrichment.” He added that “With the support of a strong, public-private partnership, we look forward to scaling up production to meet the full range of commercial and national security requirements for enriched uranium, including HALEU for advanced reactors and LEU for the existing reactor fleet.”

While Centrus welcomes appropriations for LEU and HALEU supplies (the company has responded to requests for proposals for both HALEU enrichment and deconversion), the Russian uranium ban puts Centrus in an interesting position. Centrus once provided a substantial share of the LEU used in the United States from its long-shuttered Paducah and Portsmouth gaseous diffusion plants. Now, the company is in a long-term supply contract with Russian government–owned TENEX for deliveries of LEU.

“When the legislation is enacted, we will apply for waivers from the secretary of energy and other applicable government agencies to request permission to continue supplying LEU to our customers,” Centrus said in a statement released with its first-quarter results. “It is uncertain whether any waiver would be granted and, if granted, whether any waiver would be granted in a timely manner. The company anticipates having adequate liquidity to support its business operations for at least the next 12 months.”

Meanwhile, Centrus has produced 135 kg of HALEU at the Piketon, Ohio, American Centrifuge plant as part of the DOE demonstration project.

GLE is bullish: “The fundamentals that underpin global growth in nuclear power have never been stronger, and this is precipitating positive market conditions across the nuclear fuel cycle,” said Michael Goldsworthy, Silex Systems CEO and managing director, as he introduced a May 15 investor presentation. Together with joint venture partner Cameco, Silex owns Global Laser Enrichment (GLE)—the exclusive licensee of Silex’s laser-based uranium enrichment technology.

In March, Silex announced that GLE’s test loop pilot demonstration facility and operational safety programs had been approved by the Nuclear Regulatory Commission for loading uranium hexafluoride feed material in preparation for the next phase of GLE’s enrichment technology demonstration. Silex also said in March that GLE’s “first commercial priority” is establishing the Paducah Laser Enrichment Facility to produce natural-grade uranium hexafluoride from tailings. The company could begin operations at the PLEF “as early as 2028.”

Urenco adds capacity: Urenco announced in July 2023 that it will expand enrichment capacity at its U.S. site in Eunice, N.M., by adding new centrifuge cascades to increase LEU capacity by about 700 metric tons of separative work units per year, or a 15 percent increase, with the first new cascades coming on line in 2025.

As NN previously reported, the U.K. government’s Department of Energy Security and Net Zero announced on May 8 that it would be the “first in Europe” to invest in HALEU, by providing cost-shared funding of £196 million (about $245 million) to Urenco to build a HALEU enrichment facility at the Capenhurst site in the northwest of England, where LEU is already produced. Urenco expects the HALEU facility to have 10 metric tons of production capacity by 2031.

Like the United States, the U.K. set up a HALEU program with separate contracts for enrichment and deconversion. Capenhurst is getting the enrichment money, and deconversion contracts will be announced later this year, according to the U.K. government.

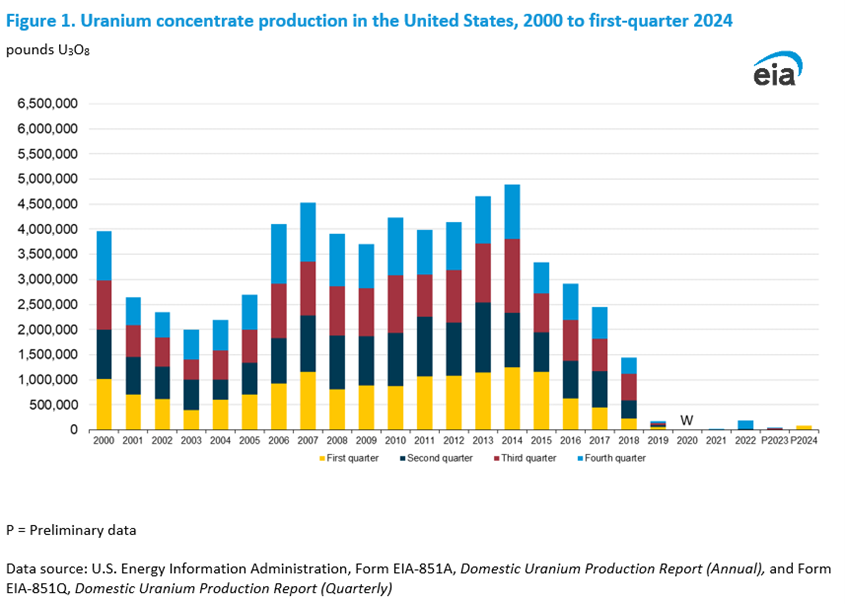

Uranium production in the U.S. is picking up after bottoming out in recent years. (Graph: U.S. EIA; https://www.eia.gov/uranium/production/quarterly/)

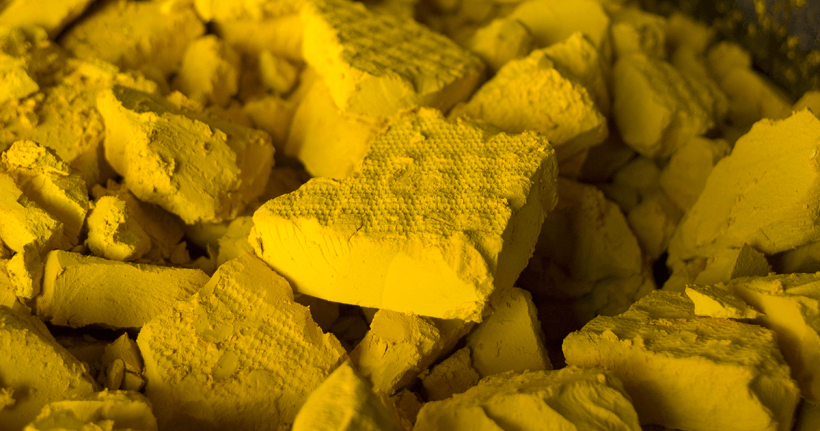

Miners: Several uranium miners operating in the United States are welcoming the Russian uranium ban as unqualified good news that follows recent strong U3O8 spot prices around $90/lb. The resurgent uranium market is spurring some companies to take their operations off standby and invest in new facilities. The latest quarterly Domestic Uranium Production Report, released May 13 by the U.S. Energy Information Administration, shows that production in the first quarter of 2024 is the highest first-quarter production since 2018. But as the EIA’s accompanying graph shows, U.S. miners have a long way to go to hit the production numbers of just one decade ago.

Uranium Energy Corp: UEC welcomed the Russian uranium ban in a May 1 announcement, saying, “Upon enactment, this will strengthen United States energy and national security, ending an untenable reliance on Russian uranium imports. This new law, in conjunction with the recently passed Nuclear Fuel Security Act, creates a firm foundation for long-term growth of the U.S. uranium industry to supply the fuel that powers American households, data centers, and industrial base with clean baseload power. . . . We are delighted to have this exciting backdrop along with positive global uranium market fundamentals and advance the restart of uranium production in Wyoming this August, followed by the resumption of our South Texas operations next year.”

Peninsula Energy: Australia-based Peninsula Energy said on May 8 that its U.S. subsidiary Strata Energy is moving ahead with expansion plans for the Ross Central Processing Plant at the Lance in situ recovery projects in Wyoming. Peninsula expects that the expansion will enable higher production rates and house the company’s dry yellowcake production line. “The Lance plant construction and wellfield development projects remain on target for commissioning in late 2024,” the company said.

Cameco: First-quarter results released April 30 by the Saskatchewan, Canada–based uranium supplier—with a portfolio that includes uranium mining operations in the United States and interests in Westinghouse and GLE—said, “The geopolitical events that have been amplifying global supply chain and transportation risks are continuing to have a significant impact on nuclear fuel customer procurement strategies. Utilities are adjusting their supply chains to ensure reliable supply, with increasing competition to secure long-term contracts for uranium products and services.” Cameco expects it will “benefit from the significant tailwinds associated with having licensed and permitted operations in geopolitically stable jurisdictions.”

Ur-Energy: Colorado-based Ur-Energy’s CEO John Cash said on May 6 that “We are encouraged to see unanimous bipartisan backing of a bill that is likely to result in strong support for western suppliers of nuclear fuel components, including Ur-Energy. We believe we are in the right place at the right time to help fill the uranium supply gap, and we will continue to advance production at Lost Creek and Shirley Basin and look for other opportunities to expand our U.S.-based production portfolio.”