“Whole-of-government” approach suggested for U.S. nuclear to compete with China

The recent article “How Innovative Is China in Nuclear Power?” published by the Information Technology and Innovation Foundation (ITIF) describes how China has become the world’s leading proponent of nuclear energy. The reason, the article maintains, is because its nuclear industry has been “supported by a whole-of-government strategy that provides extensive financing and systemic coordination.”

The article recommends that the United States take action “to develop a coherent national strategy and whole-of-government approach to reanimating the deployment of modern nuclear reactor technology.”

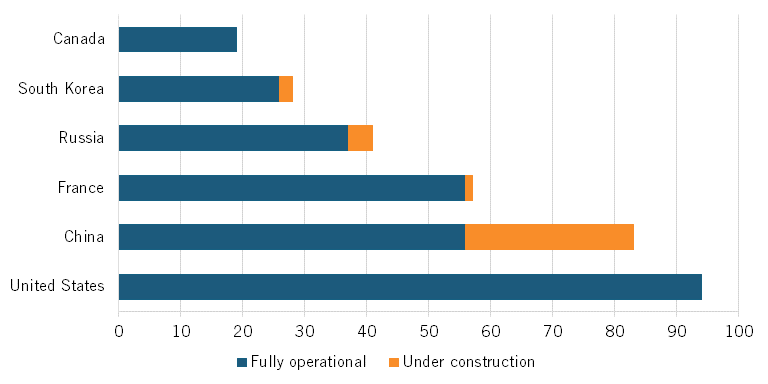

Looking ahead: China is probably 10–15 years ahead of the United States in nuclear technology, including the ability to deploy fourth-generation nuclear reactors, the article notes. In addition, there are currently 27 nuclear reactors under construction in China to complement its existing fleet of 56 reactors. “The country expects to build 6 to 8 new nuclear power plants each year for the foreseeable future, with the country surpassing the United States in nuclear-generated electricity by 2030,” the article describes. “China intends to build a total of 150 new nuclear reactors between 2020 and 2035.”

Systemic innovation: China’s thriving nuclear industry has less to do with technology innovation and more to do with “systemic and organizational innovation,” the article continues. “This especially refers to the country’s coherent national strategy toward nuclear power—at both federal and provincial levels—which entails a range of supportive policies from low-interest financing, feed-in tariffs, and other subsidies that make nuclear power generation cost competitive to streamlined permitting and regulatory approval (i.e., of safety and environmental impact assessments), to coordinating supply chains in an effective fashion.”

China is also aggressively pursuing nuclear fusion. The government recently established a national industrial consortium to promote the development of nuclear fusion technology, led by the China National Nuclear Corporation, with the hope of beginning large-scale commercial production of fusion energy by 2050.

China’s commitment: China is committed to next-generation nuclear technology. The “flagship of China’s nuclear fleet,” according to the article, is the Shidaowan-1 power plant, “the world’s first fourth-generation nuclear reactor to come on line. The facility features two high-temperature, helium gas-cooled modular pebble bed (HTR-PM) reactors that can produce 250 MW each, alongside a steam generator with an installed capacity of 200 MW.”

China also has “the world’s first multipurpose SMR [small modular reactor] demonstration project, known as the Linglong One. . . . the first SMR to receive approval from the International Atomic Energy Agency (IAEA).”

In December 2021, “China became the third country to develop a floating nuclear reactor, the ACPR50S, which has been designed to endure a once-in-10,000-years weather catastrophe.” China National Nuclear Power “connected a 600 MW FBR [fast neutron reactor] to the grid in 2023 and expects to launch a second by 2026. Later this year, the Shanghai Institute of Applied Physics is slated to launch the world’s first molten salt and thorium nuclear reactor, the TMSR-LF, in China’s Gansu province. The article adds that the China is also considering whether to build a commercial 1,000 MW FBR [fast breeder reactor] in the coming years.”

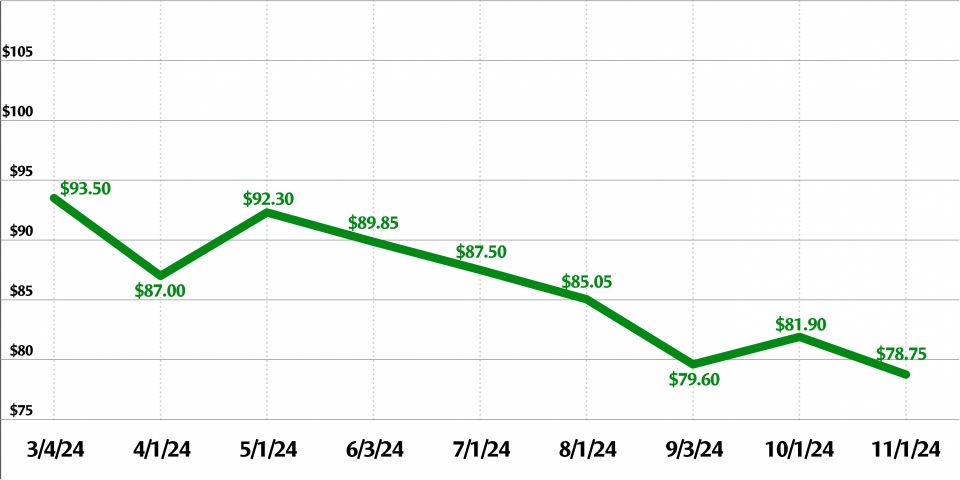

Government policies: The Chinese government has policies in place that are helping the country’s nuclear industry. Industry analyst Kenneth Luongo is quoted in the article as saying that China doesn’t “have any secret sauce other than state financing, state supported supply chain, and a state commitment to build the technology.” The country’s “feed-in tariff” decreases the cost of consumption, reducing “the price of nuclear power in China to about $70 per MW-hour, compared with $105 in America and $160 in the European Union.”

Low-interest loans from state-backed banks also allow China to “build [nuclear] plants for about $2,500 to $3,000 per kilowatt, about one-third of the cost of recent projects in the United States and France. Chinese provincial governments often also provide free or discounted land, further lowering operating costs in China.”

Value added tax (VAT) rebates, localized supply chains, and plans for the export of nuclear products and services are other policy factors that are benefitting China’s nuclear industry.

Coherent national strategy: If the United States “is to again become a leader in the nuclear reactor industry, it will need to likewise adopt a coherent national strategy,” the article notes, with a whole-of-government approach that includes “sufficient staffing at federal R&D and regulatory agencies to support the innovation, down-selection, regulatory approval, and deployment of new reactor types; incentives, tax credits, or attractive financing that facilitate the production of cost-competitive nuclear energy; and policies such as streamlined export credit programs that facilitate exports from U.S. nuclear reactor producers.”

The article praises the Department of Energy’s Advanced Reactor Demonstration Program for seeking “to speed the demonstration of advanced reactors through cost-shared partnerships with U.S. industry” and advises that changes “should be predicated on the recognition that America’s current nuclear installed base is aging rapidly, and, more importantly, that modern nuclear reactor technologies are substantially safer and more efficient.”