According to the article, “While the European energy crisis is essentially connected to the Russian invasion of Ukraine and the soaring gas prices, not all observations can be linked to this reason. In particular, we conclude that the stark changes in Norway and France are strongly related to two simultaneous but independent events: The high unavailability of French nuclear power plants and the opening of the NordLink interconnector between Norway and Germany.”

Bidding zones: The article's authors, who specialize in the areas of statistical physics and network science, explain the background and purpose of their study in the article's abstract:

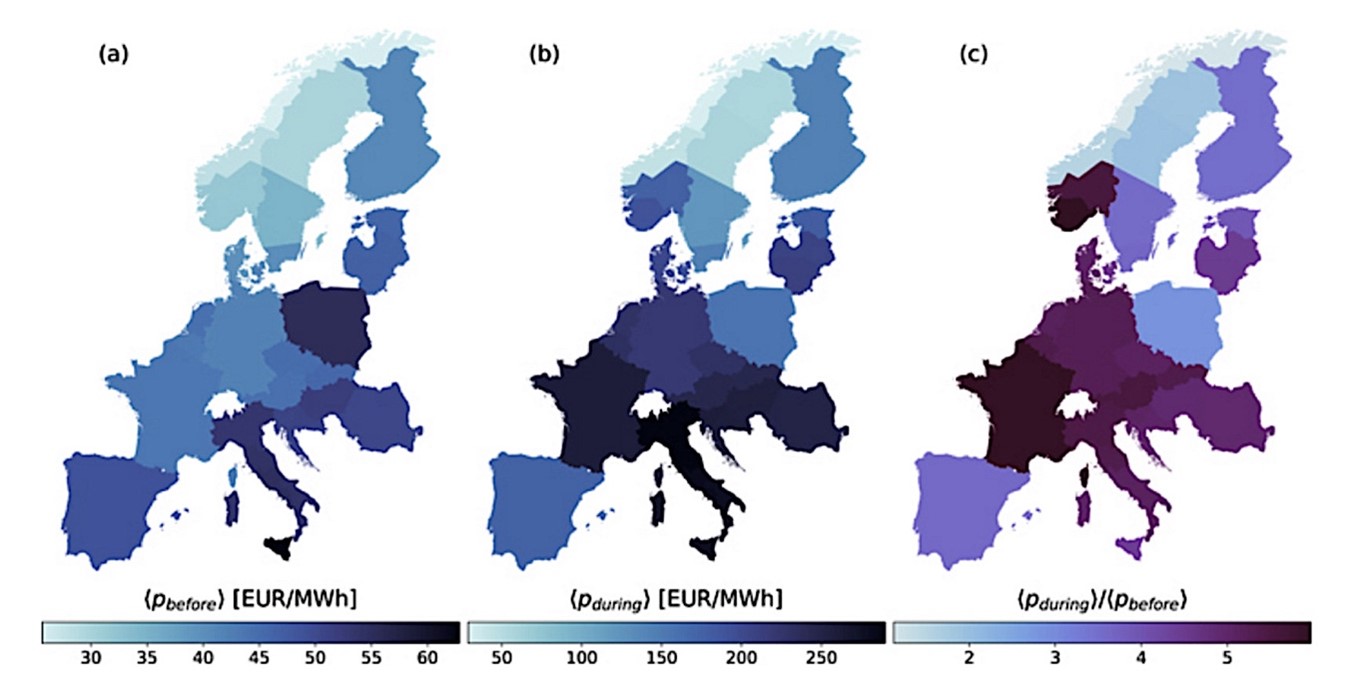

The European power system is divided into several bidding zones, each having an individual electricity market price. While individual price time series have been intensively studied in recent years, spatiotemporal aspects have received little attention. This article provides a comprehensive data-centric analysis of the patterns and correlations of the European day-ahead electricity prices between 2019 and 2023, characteristically abnormal due to the energy crisis in Europe. We identify the dominant communities of bidding zones and show that spatial differences can be described with very few principal components.

Spatiotemporal patterns: A press release about the article explains that the authors first identified groups of European countries in which energy markets are strongly correlated. They then identified “fundamental spatiotemporal patterns within the electricity price/time data” from all of the countries. They used the data to analyze how these patterns changed during the energy crisis, finding that although cutoffs of Russian natural gas supplies were frequently linked with skyrocketing electricity prices in Europe, “other factors were simultaneously at play with impacts that should not be underestimated.”

Unavailability of nuclear: One of the authors—Dirk Witthaut, a professor of network science at Forschungszentrum Jülich and the University of Cologne—described a key finding thusly: “Remarkably, France and southern Norway saw the strongest increase in electricity prices—although they do not rely on Russian gas for electric power plants.” The authors partly attributed the price increases in these countries, as previously noted, to the unavailability of nuclear power in France (due to extended maintenance shutdowns) and the beginning of operation of the NordLink power interconnector between Norway and the European continent.

Integrated markets: According to the article, “Most bidding zones in Continental Europe were brought together during the energy crisis: Correlations increased, and the number of relevant principal components decreased. Opposite effects occur in the Nordic countries and the Iberian Peninsula where correlations decrease and communities fragment.”

Witthaut noted that the study results “emphasize that a national perspective on electricity systems can be quite misleading. Europe’s electric power system is highly integrated, which is overall highly beneficial for the customers.”

Main conclusions: The authors summarized their overall findings in the article’s conclusion:

The European energy crisis starting in 2021 brought about significant changes both in the average electricity prices and in the spatiotemporal correlations and patterns, in particular, the community structure. While correlations in Continental Europe increased, the communities in the Nordics fragmented. Stark changes were observed for France, Norway, and the Iberian Peninsula. The Southern Norwegian bidding zones became strongly coupled with the German–Luxembourg bidding zone and, thus, joined the Northern Continental community. France saw a strong increase in daily prices and turned from the Northern to the Southern European community, with increased correlations to Italy. In contrast, correlations to Spain diminished such that Portugal and Spain left the Southern Continental community. . . .

Our results shed light on the spatiotemporal interactions and dependencies of national electricity systems and markets. Cross-border trading is an important measure to balance the fluctuations of renewable power sources. A strong development of cross-border interconnection capacities is foreseen in the next decade; such that trading will become increasingly important.

Model all countries together: According to Witthaut, “Most scientists only look at one national market, but the interactions with other countries must not be neglected. We’ll get accurate forecasts only if we model all countries together,” adding, “We need statistical tools that can quantify causal effects.”