Top findings: The FIA has 37 private fusion developers as members, and dozens of other companies that want to support a fusion energy industry—suppliers, engineering firms, investors, and the like—as affiliate members. Membership is not a requirement to participate in the annual report, according to association.

The FIA’s latest report, like the 2023 version, offers a platform for FIA member companies and others to publish information about their technology, funding, commercialization plans, and recent developments. It also includes data from a survey of private fusion companies.

According to 45 survey respondents, timelines for fusion energy generation remain on track for the 2030s. Eighty-nine percent of the respondents anticipate that fusion will provide electricity to the grid by the end of 2030s, while 70 percent expect that milestone by the end of 2035. “However, there are still major challenges to overcome and, between 2025 and 2030, two-thirds of respondents believe power efficiency will be a major challenge, while the same proportion (66 percent) believe funding will be a barrier to success,” according to the FIA.

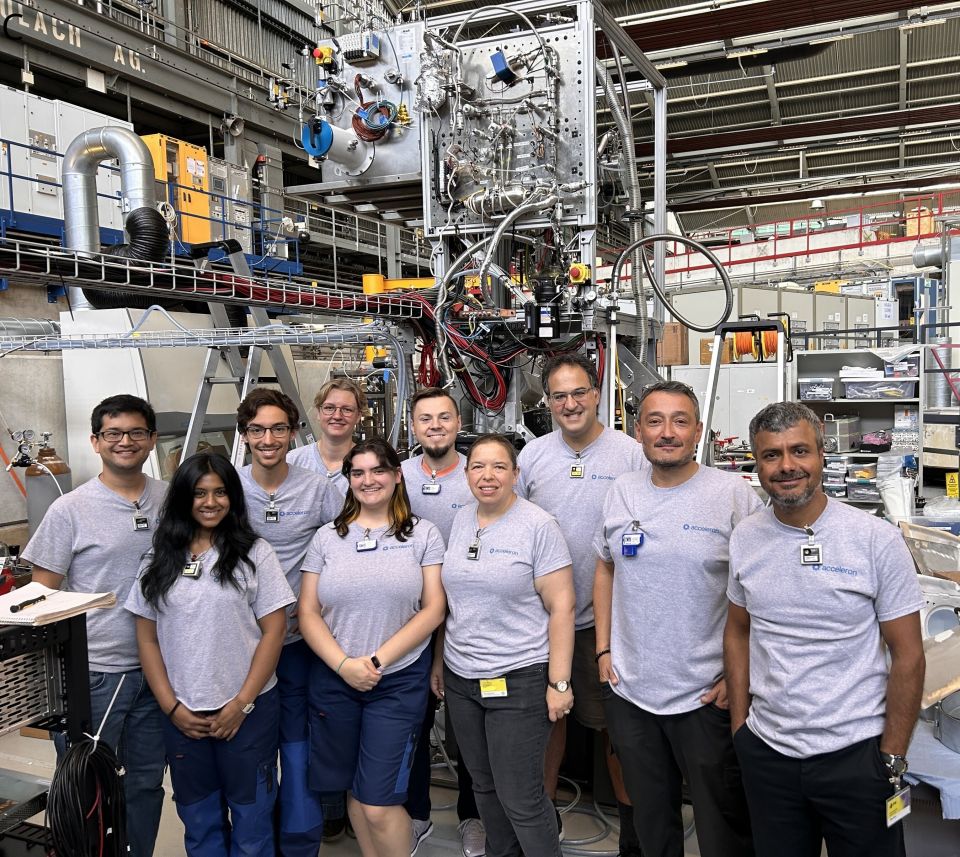

This year has seen employment growth at private fusion companies, with over 4,000 people employed around the world, a 34 percent increase over 2023 numbers and a 300 percent increase over 2021. The FIA reports that nearly half of those employees are engineers (48 percent), one-quarter are scientists (25 percent), and one-quarter are in other roles (27 percent).

Twenty-five companies in the survey are headquartered in the United States, while the United Kingdom, Germany, Japan, and China each have three. Switzerland hosts two fusion companies, and Australia, Canada, France, Israel, New Zealand, and Sweden each have one represented in the FIA report.

What about funding? The fusion industry has attracted a total of over $7.1 billion in investments, according to the report, with over $900 million in new funds in the last year. “As part of that,” the FIA says, “total public funding increased by 57 percent in the last 12 months to $426 [million], showing governments increasingly see public-private partnerships as central to making commercial fusion a reality.”

Funding includes a wide range of investments across many of the 45 fusion companies surveyed, with notable deals including $100 million for Xcimer, $90 million for SHINE Technologies, and $65 million for Helion.

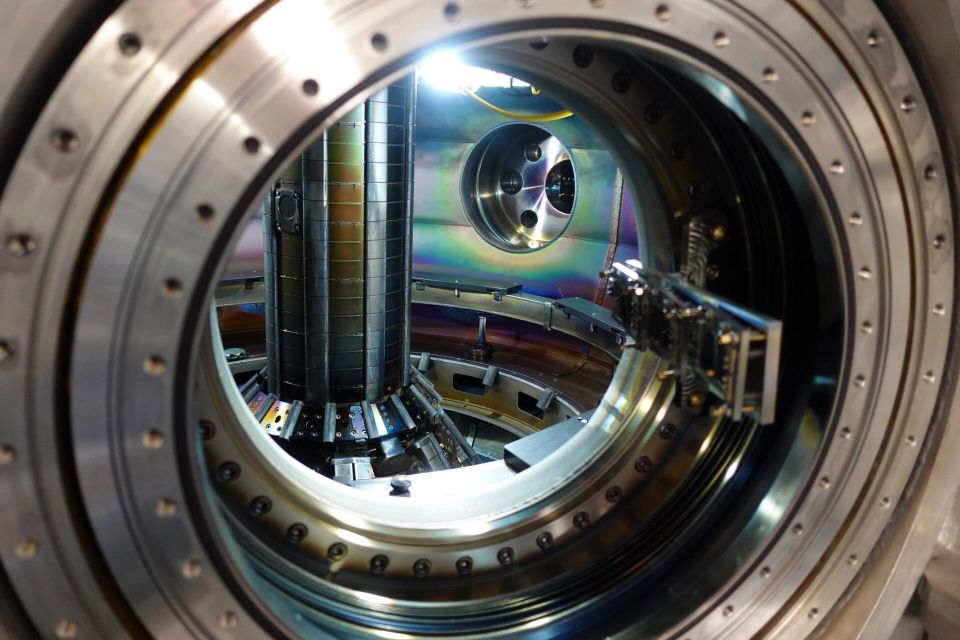

What about supply chain? The FIA tackled fusion supply-chain issues in a separate report, released July 2. Based on responses from 20 private fusion developers, the report notes that the fusion company respondents plan to spend 21 percent more on their supply chain in 2024, compared with 2023. Among the critical components highlighted as having current or future supply risks include cryogenic devices, high-temperature superconducting wire, power electronics, and vacuum chambers.

FIA supply-chain member companies were also surveyed, and 77 percent of respondents reported plans to invest in their capacity to support the fusion industry, while all those surveyed plan to “expand their work with fusion companies over 2024.”

According to the FIA, more certainty in financing and policy is needed to “give the supply chain confidence to scale up to meet future needs of the fusion industry.”

“Given enough lead time, suppliers should be able to scale as the fusion industry requires, but new production capabilities can take 1–3 years, and most suppliers will not invest until they have firm commitments or investments,” the report states. “If fusion players cannot make long-term financial commitments, then investors and/or governments will need to provide some security to enable this accelerated rate of expansion.”

Following new federal funding and programs announced in June to support a “bold decadal vision” for fusion energy in the United States, and the enactment of the Fusion Energy Act in July, fusion energy trade group the Fusion Industry Association has released its latest annual survey of fusion companies: The Global Fusion Industry in 2024.

Following new federal funding and programs announced in June to support a “bold decadal vision” for fusion energy in the United States, and the enactment of the Fusion Energy Act in July, fusion energy trade group the Fusion Industry Association has released its latest annual survey of fusion companies: The Global Fusion Industry in 2024.