Liftoff report lifts the lid on cost and risk in push to nth-of-a-kind reactors

The Pathways to Commercial Liftoff: Advanced Nuclear report that was released in March 2023 by the Department of Energy called for five to 10 signed reactor contracts for at least one reactor design by 2025. Now, 18 months have passed, and despite the word “resurgence” in media reports on the U.S. nuclear power industry, 2025 is fast approaching with no contracts signed.

So the DOE is back with an updated report that attempts to flesh out the business case for new nuclear reactors and break through first-mover reluctance, in part by detailing the benefits already available in the Inflation Reduction Act that—in some cases—amount to “buy one reactor, get one free.” Starting from the goal of deploying 200 gigawatts of new nuclear power plants by 2050—tripling the fleet—the report draws on new reports and models on new reactor costs and siting.

In an October 4 webinar introducing the revisions, remarks from Vanessa Chan, director of the DOE’s Office of Technology Transitions; Jigar Shah, director of the DOE’s Loan Projects Office (LPO); and Kelly Cummins, acting director of the Office of Clean Energy Demonstrations, preceded a presentation by Julie Kozeracki, director of strategy for the LPO, who led work on the original Liftoff report and its revision.

In an October 4 webinar introducing the revisions, remarks from Vanessa Chan, director of the DOE’s Office of Technology Transitions; Jigar Shah, director of the DOE’s Loan Projects Office (LPO); and Kelly Cummins, acting director of the Office of Clean Energy Demonstrations, preceded a presentation by Julie Kozeracki, director of strategy for the LPO, who led work on the original Liftoff report and its revision.

Nudging the goal posts: The original Liftoff report said, “If deployment starts by 2030, ramping annual deployment to 13 GW by 2040 would provide 200 GW by 2050; a five-year delay in scaling the industrial base would require 20+ GW per year to achieve the same 200 GW deployment and could result in as much as a 50 percent increase in the capital required.”

The updated report acknowledges one lost year with no first movers and now sees the U.S. as capable of ramping to 13 GW annual deployment by 2041, not 2040. But the key goal hasn’t changed: “The first step for achieving liftoff is generating a committed order book,” Kozeracki said. “Those are signed contracts, not just [memoranda of understanding] or letters of intent, but signed contracts for that critical mass of five to 10 reactors of the same design.”

To get there, the report says, “The nuclear industry must solve the issue of spreading early costs over subsequent reactors such that there is no longer a benefit to waiting for the Nth project.”

Getting beyond FOAK: First-of-a-kind deployments have more inherent risk and cost than nth-of-a-kind deployments, and no utilities or end users have volunteered to be first. “This is the thing that's been really keeping me up at night,” Chan said during the webinar. “What we're seeing is the fact that everyone is first in line to be seventh, eighth, or ninth—no one is first in line to be first, second, or third.”

The updated report proposes consortium models to share the risks and costs of the first plants. “A consortium approach is actually going to help us aggregate demand and push through the first-mover disadvantage to realize and share cost reductions. Consortium approaches allow customers to all be one-fifth of the order book, versus waiting to be fifth,” Chan said.

Time for more AP1000s? The quickest option for getting new capacity on the grid would be deploying more AP1000s, now that Vogtle has been completed. A date of 2032 for new AP1000 capacity would be “ambitious but achievable,” Kozeracki said.

“Let's be clear, it was impolite, in polite society, to talk about more AP1000s in the U.S. just a year ago,” Kozeracki said. “But now that Vogtle Units 3 and 4 have come on line . . . customers are now doing a closer analysis of what happened at Vogtle. So, for example, Vogtle began construction with an incomplete design, an immature supply chain, and an untrained workforce. But now, the AP1000 design is complete, there is supply chain infrastructure, and Vogtle trained over 30,000 workers.”

We don’t need more “special snowflakes”: Although the existing fleet is all large light water reactors using just two technologies—boiling and pressurized water reactors—“we've actually built over 50 different unique designs, so almost all of the nuclear reactors in this country are ‘special snowflakes,’” Kozeracki said. Putting it another way, “it's important to remember that we've effectively done over 51 first-of-a-kind projects and it is essential to downselect and standardize reactor designs to actually come down the cost curve, because you can imagine that building 10 first of the kind projects is a lot less efficient than building 10 within a design,” she said.

Downselecting is not the DOE’s job, Kozeracki was quick to add. “In the United States, we are private sector led and government enabled. So it's going to be up to the industry and to customers to pick the designs they like and are most comfortable with,” Kozeracki said. “But downselecting and standardizing reactor designs is essential for reducing costs for everyone.”

With 200 GW of capacity to add by 2050, ensuring that a deployed design has contracts for at least five to 10 reactors still leaves room for multiple different designs to reach nth-of-a-kind. The updated report makes it clear that large and small reactors, including Gen III+ LWRs and Gen IV non-LWRs, all have the potential to find a customer base.

What’s the true cost? Kozeracki waded into details on Vogtle cost overruns, inflation implications, and that most “flawed” of metrics, levelized cost of electricity (LCOE).

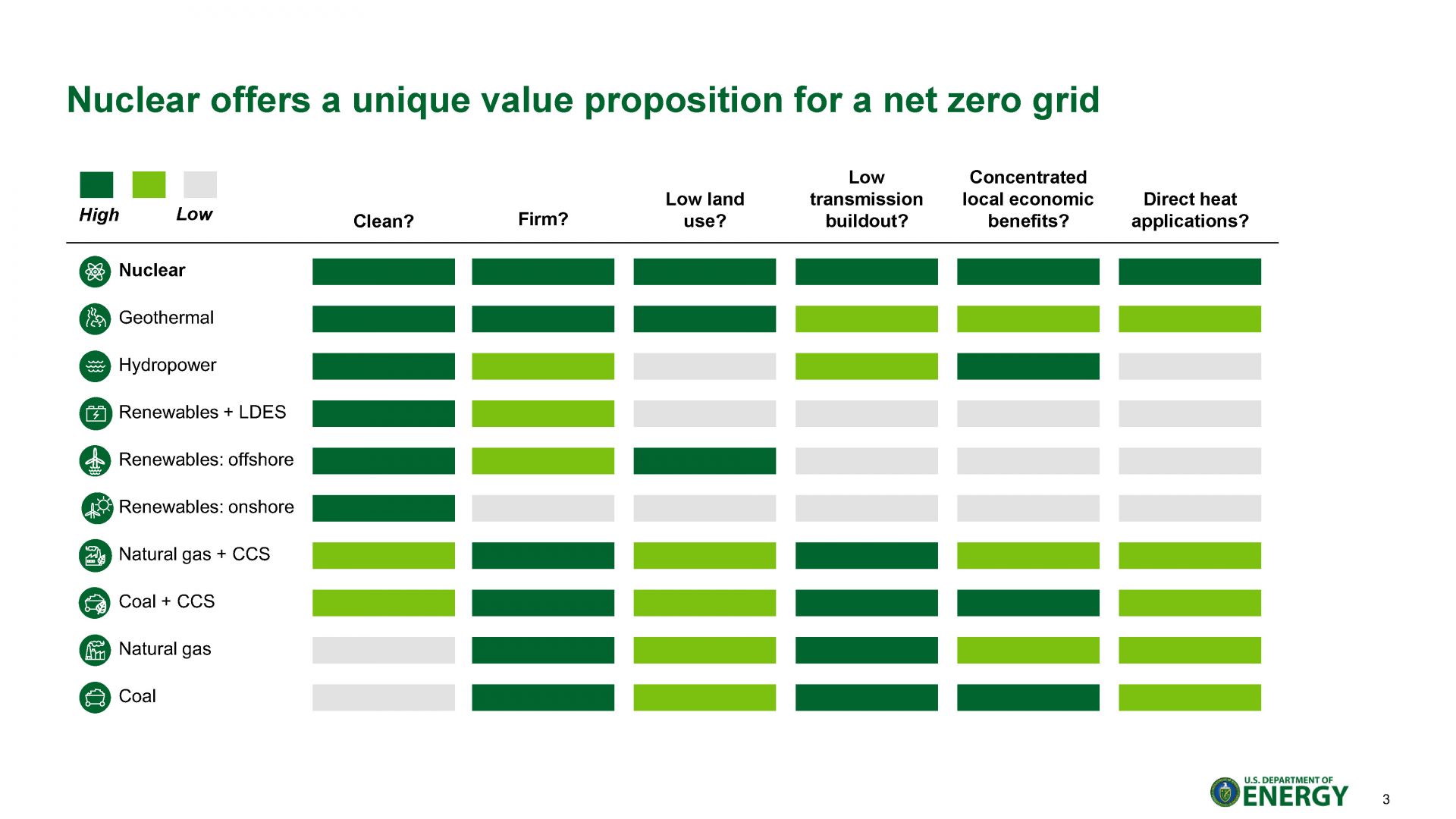

“In the report we have a few pages that talk about how flawed of a metric LCOE is and what it leaves out, but the people want LCOE and so we give them LCOE,” Kozeracki said. What does it leave out? For starters, clean energy benefits, transmission and other electricity system costs, the cost of added capacity to “firm” the supply of variable generation, and nuclear energy’s decades of continued generation beyond the capital recovery period assessed in LCOE.

The report breaks down Vogtle’s cost overruns using figures from a recent MIT report and suggests those overruns are actually initial cost underestimates. As the updated Liftoff report states, “The cost of Vogtle Units 3 and 4 is not the correct anchor point for estimating additional AP1000s given costs that should not be incurred again.”

The final cost for Vogtle-3 and -4—about $32 billion—includes an overnight capital cost of $11,000 per kilowatt and an LCOE of $126 per megawatt-hour, which, with today’s inflation and 5 percent interest rates, would be about 50 percent greater today. The updated Liftoff report suggests that 50 percent increase can be more than offset by cost reductions from the IRA and various LPO benefits to arrive at an LCOE of $96 per megawatt-hour. Further reductions from a shorter (six-year) construction time and project efficiencies have the potential to reduce costs by another 40 percent.

“Then you're looking at an LCOE that's closer to $60 or $80 [per megawatt-hour], and if you don't believe me, you can run the numbers yourself. We will be publishing the model that we used for this,” Kozeracki said.

Buy one reactor, get one free? The IRA created substantial tax credits for nuclear, including a production tax credit for existing reactors and an investment tax credit for new reactors and, in some cases, uprates on existing reactors.

On top of the ITC, an “energy community” tax credit bonus would apply to 20 operating nuclear sites and five formerly operating nuclear sites, Kozeracki said. “For the ITC, being in an energy community allows you to get up to a 40 percent investment tax credit. And if you add the domestic content bonus, that gets you to a 50 percent ITC. And for those keeping score at home, a 50 percent investment tax credit is ‘buy one reactor, get one free.’”

Kozeracki reframed those benefits as a kind of cost-overrun insurance. “Following the publication of the initial report, a lot of customers and other stakeholders said that they needed something that looked or felt like cost-overrun insurance in order to commit to new nuclear,” Kozeracki said. “And it's really important to understand that that 30 to 50 percent investment tax credit functionally serves as overrun insurance because the ITC applies to the entire capital cost of the project, regardless of initial budget. . . . The government is already offering to pay for 30 to 50 percent of the overrun.”

“I often feel that there has been an underappreciation of the heft of the IRA benefits, not just in the tax credits, but in what the increased LPO authorities mean for new nuclear,” Kozeracki said. “We are looking forward to sharing those resources with folks, getting new reactors built, and getting those dollars out the door.”