DOE names four companies to split $2.7 billion in future HALEU enrichment contracts

If we needed more proof that this is a “nuclear week”—in the words of Energy Secretary Jennifer Granholm on Wednesday, as she announced small modular reactor funding while celebrating tech company investments in advanced reactors—the Department of Energy came through late yesterday when, just nine days after announcing six contracts for high-assay low-enriched uranium (HALEU) deconversion, it announced four contracts for HALEU enrichment services worth up to $2.7 billion. Those contracts are going to Centrus Energy’s American Centrifuge Operating subsidiary, General Matter, Orano Federal Services, and Urenco USA’s Louisiana Energy Services.

The contracts for Centrus, which is already producing limited quantities of HALEU for the DOE; for Orano, which announced in September that it wants to build an enrichment facility in Oak Ridge, Tenn.; and for Urenco, the only commercial enricher currently operating in the United States, come as no surprise. But the group does include a dark horse—General Matter, Inc., based in San Francisco, Calif.

Selling points: Like the deconversion contracts announced last week, the four indefinite delivery/indefinite quantity HALEU enrichment contracts have a minimum contract value of just $2 million and amount to a first round of contracting.

“Under these contracts, selected companies will bid on future work to produce and store HALEU in the form of uranium hexafluoride gas to eventually be made into fuel for advanced reactors,” the DOE said. Those future contracts offer a maximum combined value of $2.7 billion over a 10-year period. And because uranium enriched at one facility up to the 5 percent or 10 percent U-235 limits of low-enriched uranium or LEU+ could theoretically be shipped to a different facility for enrichment up to the HALEU limit of 19.75 percent, future contracts could play to the strengths of each enricher.

Cognizant of continued competition, the awardees took the opportunity yesterday to promote their perceived selling points for future contracts: Centrus has centrifuge technology designed and built in the United States, Urenco has an existing U.S. gaseous centrifuge enrichment facility with expansion plans, Orano has experience with “modern ultracentrifugation technology” and with serving as a contractor to the DOE. Only General Matter was relatively mum on how it can “help address our nation’s HALEU needs.”

In their words: Each of the four HALEU enrichment awardees issued comments yesterday.

Centrus—Centrus Energy president and chief executive officer Amir Vexler announced that its award “could facilitate the potential expansion of Centrus’s first-of-a-kind HALEU production capacity to help meet the needs of the advanced nuclear industry and the nation,” adding that, “It represents a critical piece of the public-private partnership we are working to build so that we can restore a robust, American-owned uranium enrichment capability to power the future of nuclear energy.” Centrus, which also received a HALEU deconversion contract last week, is a U.S. publicly traded company based in Bethesda, Md., and created in 2014 after a restructuring of USEC Inc.

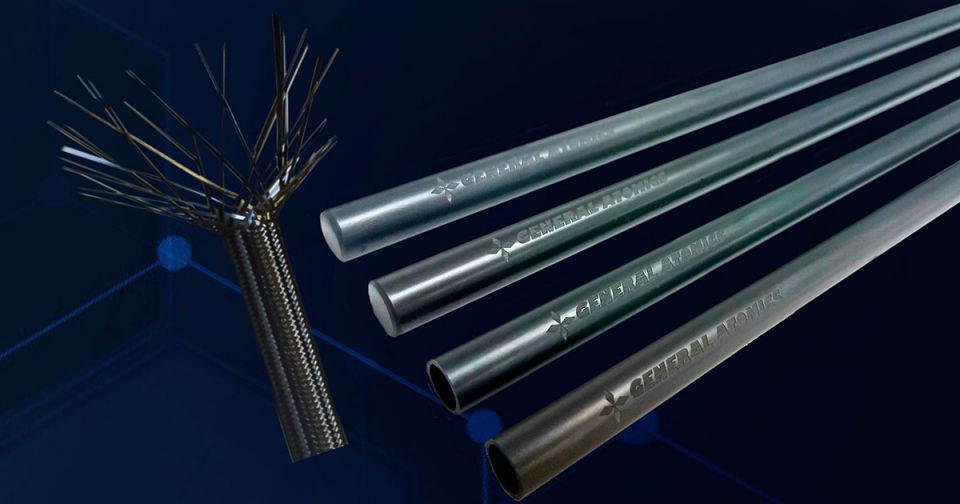

American Centrifuge Operating will manufacture its centrifuges and supporting equipment “exclusively in the United States, relying upon domestic engineering and a domestic supply chain that currently spans 14 major, American-owned suppliers in 13 states and is expected to grow,” Centrus said.

General Matter—In response to an inquiry from Nuclear News, a General Matter spokesperson said: “We are excited to be selected for the Department of Energy’s HALEU Enrichment Acquisition program and to help address our nation’s HALEU needs. The DOE has been great to work with and we appreciate their support. We look forward to partnering with the entire DOE team to help meet the nation’s energy production and climate goals.”

The spokesperson declined to answer specific questions, including on the enrichment technology the company plans to use, saying “We're not sharing any additional information on the company at this time.” The company’s website is similarly restrained.

Orano USA—Orano, like Centrus, is bagging both HALEU enrichment and deconversion contracts and Jean-Luc Palayer, Orano USA CEO, said yesterday that “we have been participating from the very beginning in the DOE’s process for developing U.S. HALEU capacity that is reliable, diversified, and commercially viable.”

Orano USA, based in Bethesda, Md., is a subsidiary of Paris-based company Orano Group, which is majority owned by the French government. Orano operates uranium conversion, enrichment, and deconversion facilities in France. The company said its plan for “significant investment in the design and construction of an American HALEU enrichment facility would use existing modern ultracentrifugation technology to promptly and securely deliver HALEU capacity without the need for additional extensive research and development.”

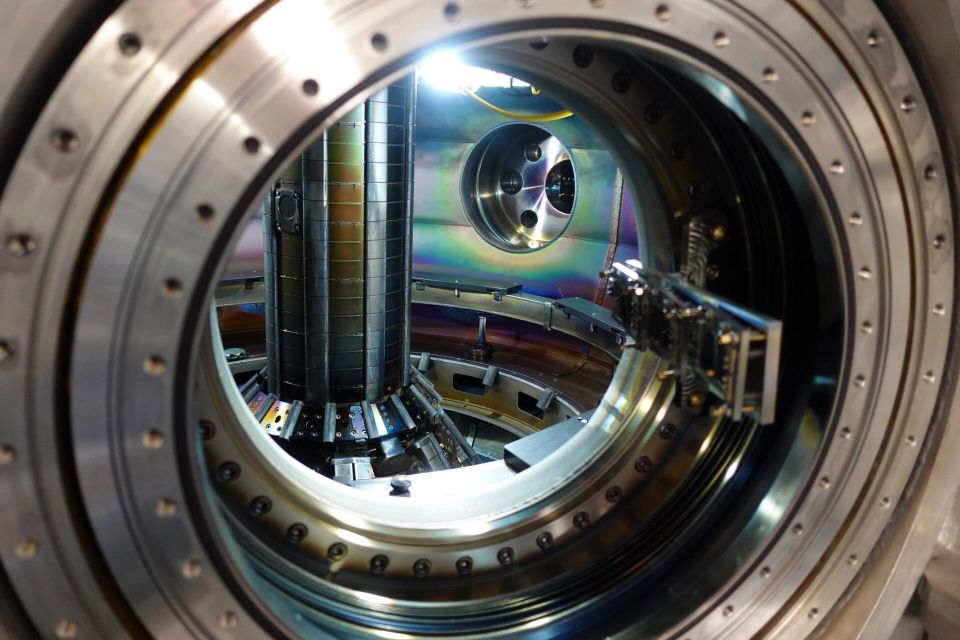

Urenco USA—Urenco USA, operating in Eunice, N.M., is a subsidiary of UK-based Urenco Limited—which is owned in equal thirds by the British, Dutch, and German governments—and is currently the only commercial enricher operating in the United States, supplying about one-third of U.S. low-enriched uranium. Urenco USA has begun a licensing process to increase its enrichment up to 10 percent U-235—the limit for a Category III fuel facility license—which Urenco notes is “an important stepping stone towards the production of HALEU.”

John Kirkpatrick, managing director of Urenco USA, said the company’s “U.S. workforce has the knowledge and experience to play a leading role in the production of HALEU and other advanced fuels, operating for more than a decade securely under intergovernmental treaties to ensure the peaceful use and safeguarding of nuclear technology.”

An achievement for the HALEU Availability Program: “Today’s announcement represents the Biden-Harris administration’s latest efforts to build a secure domestic HALEU supply chain, which is essential to bringing advanced nuclear reactors online and meeting the growing demand for clean, reliable electricity,” said Granholm, quoted in the DOE’s press release.

The United States still lacks commercial HALEU enrichment capabilities to support the deployment of advanced reactors. But since late 2020, when the DOE was first charged with creating a HALEU Availability Program in the Energy Act of 2020, the United States has done all this and more:

- Set up the HALEU Availability Program.

- Set up a HALEU Consortium.

- Extended Centrus’s HALEU demonstration contract.

- Partnered with allied nations—the Sapporo 5—to secure a supply of enriched uranium free from Russian influence.

- Issued a draft and final HALEU Availability Program environmental impact statement.

- Issued draft and final deconversion and enrichment requests for proposals.

- Announced contracts for deconversion and, yesterday, for enrichment.