Some good news for a change

Help comes from positive news for getting nuclear energy out of its defensive corner

Recently, in a meeting room full of nuclear energy professionals, the spirit of doom and gloom from Japan's Fukushima nuclear crisis was so apparent that even the bartender serving beverages from his portable bar had noticed it.

One nuclear professional who had gone up to get something to drink was counseled by the bartender: The group in the meeting room needed to lighten up! Upon hearing about this bit of barroom psychology, I wondered if there might be some news globally that would help with this task, aside from another round of single malt scotch.

It turns out that there is. Writing this at breakfast time, with only caffeine to boost the brain cells, I find it an enjoyable task. Here's a round-up of brighter news about the nuclear renaissance.

UK U-turn on nukes

In May 2010, nuclear energy professionals in the United Kingdom thought that they felt a record-size headache coming because of the appointment of Chris Huhne as the energy minister of the new coalition government. Huhne, who made his money at Fitch Ratings grading electric utilities, had long been an arch critic of new nuclear power investments. He said in speeches to business groups that his opposition was not political but practical, in that it simply takes too long to see a return from investment in new reactors.

Since then, Huhne has executed a complete U-turn as a government minister. Faced with the stark reality that the U.K.'s current fleet of reactors must be replaced in the next decade, he has pushed ahead with an agenda that includes new builds at eight sites.

Huhne, who once described nuclear energy as a "failed technology," now says that new reactors are needed to keep the lights on.

In a speech in Parliament last week, he noted that nuclear energy will have an essential role in getting the country on track to meet its climate goals and to decrease dependence on oil and gas from the nation's North Sea oil fields.

On June 23, the U.K. government announced that there are eight sites it says are suitable for building new nuclear power stations by 2025. The sites are Bradwell, Hartlepool, Hinkley Point, Oldbury, Sellafield, Cumbria, Sizewell, and Wylfa. Reactor vendors Areva and Westinghouse are in the process of getting their reactor designs certified in the U.K.

Areva gets a new CEO

While the departure of two-term Areva chief executive officer Anne Lauvergeon generated headlines, missed in the dust up over fission politics was the news that nuclear energy will remain an essential source of energy for France and could be positioned for that role globally. The new CEO, Luc Oursel, said in his first interview with the French news media that "market fundamentals remain unchanged."

Oursel pointed out that in the next four decades, world population will grow to 9 billion people who will want energy, a decent standard of living, and less carbon emissions to stave off the effects of global warming.

Oursel said, "I remain optimistic about the future of the nuclear industry even if certain decisions to start building new reactors risk being delayed."

Coincidentally, the French government announced on June 28 that it would beef up spending on nuclear research and development, investing a total of €1 billion (about U.S.$1.43 billion). The investment is needed to continue France's reliance on nuclear energy, which provides 76 percent of all of its electricity.

Finland invites bids

In an announcement on July 1, the Finnish government said that it has sent bid documents to Areva and Toshiba for responses to build a new nuclear power station. The new plant will need to generate up to 1,700 MW and be ready to produce power by 2020 at a cost of $6-9 billion. Finnish utility Fennovoima said that the power station is being considered for one of two sites on the nation's west coast, about 600 km north of Helsinki.

In an announcement on July 1, the Finnish government said that it has sent bid documents to Areva and Toshiba for responses to build a new nuclear power station. The new plant will need to generate up to 1,700 MW and be ready to produce power by 2020 at a cost of $6-9 billion. Finnish utility Fennovoima said that the power station is being considered for one of two sites on the nation's west coast, about 600 km north of Helsinki.

A Fennovoima spokesman said that the nation is well aware of the Fukushima crisis, but has decided to go ahead with plans for two new nuclear power stations. The spokesman said that unlike Japan, Finland does not face the threat of similar catastrophic earthquakes and tsunami.

He added that the "pressing needs of Finnish consumers," who are among the highest per capita users of electricity in Europe, along with a desire for energy independence from Russian natural gas, is the basis for the commitment to the new build.

NRC grants new 20-year licenses to Salem reactors

Despite a vigorous campaign by anti-nuclear groups in New Jersey, the U.S. Nuclear Regulatory Commission has granted 20-year license renewals to the two reactors in Salem County on the state's Delaware River bay coastline. The two pressurized water reactors have been operating since 1977 and 1981 and generate just over 1,100 MW each.

According to the Energy Information Administration, New Jersey is one of the 10 largest states in terms of nuclear capacity and generation, accounting for almost 4 percent of the national totals.

Nuclear power produces half of New Jersey's electricity, making New Jersey one of six states where nuclear power is the primary energy source.

PSEG, which owns a 57-percent share of the reactors, is expected to file an Early Site Permit for a new reactor at the Salem site. Exelon owns the other 43-percent stake in the current operation.

The NRC is expected to issue a decision on license renewal for PSEG's Hope Creek power station-an 1,161 boiling water reactor-later this year.

NuScale gets funding, recalls some laid off employees

The prospects of small modular reactor developer NuScale Power, out of Corvallis, Oregon, got brighter this week. NuScale has been recalling some laid off employees. It told an Oregon wire service it had obtained "bridge funding" from an undisclosed investor group, allowing the firm to restore about 20 positions.

The prospects of small modular reactor developer NuScale Power, out of Corvallis, Oregon, got brighter this week. NuScale has been recalling some laid off employees. It told an Oregon wire service it had obtained "bridge funding" from an undisclosed investor group, allowing the firm to restore about 20 positions.

Last winter the firm's funding was waylaid by an unrelated regulatory issue with one of its primary investors. NuScale was not named in the U.S. Securities and Exchange Commission review of the Michael Kenwood Group.

Bruce Landry, a spokesman for NuScale, told the wire service that the firm is working to get new investors, which will allow it to move ahead with its plans to develop, license, and market a 45-MW lightwater reactor.

While NuScale has not announced pricing, at a hypothetical cost of $4,000/Kw, a 45-MW plant would cost a utility $180 million. Such a price tag would make the job of producing nuclear energy, with well-understood LWR technology, widely affordable for many smaller utilities that cannot sign up to build 1,000-MW units.

Export markets are attractive to NuScale, which has established marketing efforts overseas, including one in Mumbai, India.

TVA signs letter of intent with B&W for 125-MW SMR

The Tennessee Valley Authority and Babcock & Wilcox announced on June 16 that the two firms have signed a letter of intent that defines project plans to design, license, and build up to six 125-MW mPower small modular reactors at TVA's Clinch River site in Tennessee.

The Tennessee Valley Authority and Babcock & Wilcox announced on June 16 that the two firms have signed a letter of intent that defines project plans to design, license, and build up to six 125-MW mPower small modular reactors at TVA's Clinch River site in Tennessee.

In a statement, the two organizations said that the first unit could be operational by 2020. TVA plans to submit a construction permit application to the NRC in 2012, and B&W plans to submit a design certification application to the NRC in 2013.

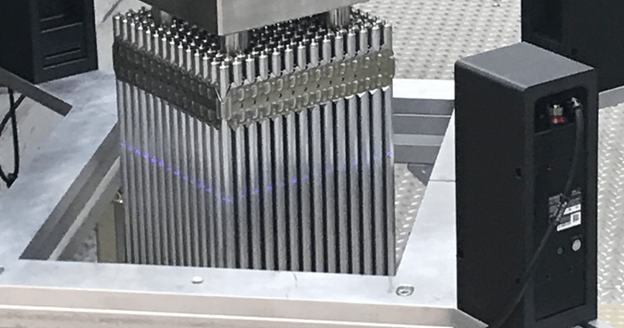

Like NuScale's 45-MW reactor concept, the B&W SMR design is based on conventional LWR design principles. B&W is developing a system test facility in Roanoke, Va., where it will spend the next three years collecting data on design and safety performance of the reactor.

B&W has often talked in industry conference presentations about a "six pack" approach for utilities, in which revenue from the first unit pays for building the second, and so on. While B&W has not released information on pricing, at a hypothetical cost of $4,000/KW, a single new SMR from the firm would cost $500 million, making the units affordable for mid-size utilities that can't bet the company on $4-billion 1,000-MW reactors.

Key issues facing licensing of SMRs include how the NRC will address staffing for multiple units, e.g., whether a single control room could manage multiple SMRs. Another issue is how to cost-effectively address security for the units, which are designed to be installed underground.

ANS Embedded Topical on SMRs

With all the good news about SMRs, it is also worth noting here at the ANS Nuclear Cafe that the American Nuclear Society will host an embedded topical meeting on SMRs as part of its winter meeting in Washington, D.C., October 30-Nov 3. The call for papers is out. Here's a brief summary of the scope of the meeting.

Small modular reactors (SMRs) have been a topic of intense interest since late 2009, when Tom Sanders established the ANS President's Special Committee. Since then, ANS has supported industry work led by the Nuclear Energy Institute to establish significant momentum toward deployment of SMRs in the next 10 years. Government interest and support has also increased from the NRC, the Department of Energy, and the Department of Commerce to create a fast-paced, ongoing nuclear dialogue among all stakeholders.

The meeting will allow participants to interact and learn about the new wave of SMRs from multiple points of view and will address technical issues, licensing approaches, university and national lab involvement, and plans for commercial realization. ANS recognizes SMRs as a key to maintaining U.S. national security and energy security through generation of clean electricity, as well as meeting the needs of a variety of industrial applications.

---------------

Dan Yurman publishes Idaho Samizdat, a blog about nuclear energy, and is a frequent contributor to the ANS Nuclear Cafe.