Competition heats up for DOE SMR funding

Westinghouse gets support from Missouri for 225-MW reactor

The race to win $452 million in cost- shared funding from the U.S. Department of Energy (DOE) for licensing and technical support to bring a small modular reactor (SMR) to market by 2022 got a new entry on April 19. Westinghouse has partnered with Ameren (NYSE:AEE) to submit a proposal based on the reactor vendor's design of a 225-MW SMR.

shared funding from the U.S. Department of Energy (DOE) for licensing and technical support to bring a small modular reactor (SMR) to market by 2022 got a new entry on April 19. Westinghouse has partnered with Ameren (NYSE:AEE) to submit a proposal based on the reactor vendor's design of a 225-MW SMR.

The proposal won enthusiastic support from elected officials, including Missouri Gov. Jay Nixon, with the promise of high-paying manufacturing jobs to build the components for the reactors in Missouri. Nixon called it a "transformational economic development opportunity."

A consortium composed of Westinghouse, Ameren, and regional electrical utilities will prepare the proposal to submit to the DOE. The cost-share agreement covers a five-year period and would involve equal spending by the winning team and the government up to $904 million. The government may make two awards splitting the funds among developers.

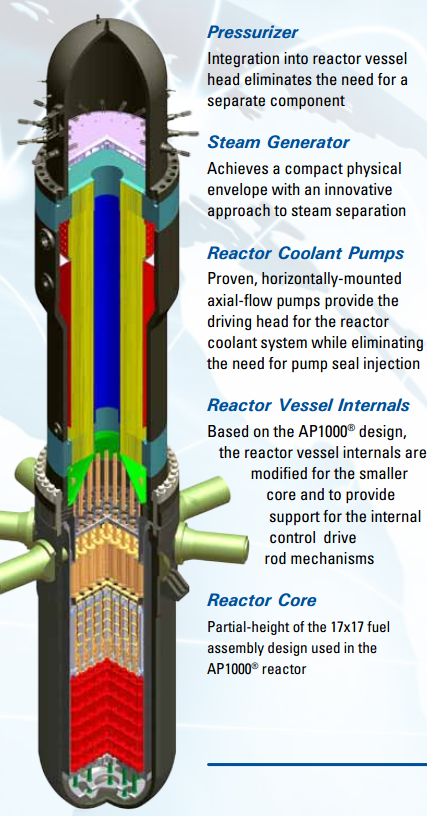

The Westinghouse SMR is a 225-MW light water reactor design based on the firm's 1100-MW AP1000, which achieved design certification from the U.S. Nuclear Regulatory Commission (NRC) last December. Westinghouse is building four units in China, and in 2012 began construction of four units in the United States-two in Georgia and two more in South Carolina.

If Westinghouse wins the DOE funding, it could submit combined license applications to build and operate, over time, up to five of its SMRs with Ameren in Missouri-eventually providing the equivalent of a single AP1000 reactor.

Kate Jackson, chief technology officer for Westinghouse, said in a statement that the first unit would be built and ready to enter revenue service within 24 months of receiving an NRC license.

Change in strategy for Ameren

Until recently, Ameren had been pursuing a legislative strategy of seeking to change a 1976 Missouri law that banned CWIP. The acronym means "construction work in progress" and it defines a rate mechanism that would, if authorized, allow a utility to charge customers for the costs of an early site permit, licensing, and construction of a new reactor as they come in.

Ameren has twice tried and failed to win legislative approval to overturn the 1976 law. In 2012, on the third iteration, Ameren sought cost recovery just for the early site permit (ESP) in hopes that the legislature might be more amenable. That tactic appeared to be working. On March 8, the Missouri House committee on utilities passed a bill supporting the more limited concept. The bill, introduced by Rep. Jeanie Riddle (R-Mokane), provides for up to $45 million to be recovered for an application for an ESP.

Ameren President Warner Baxter told the Kansas City Star on April 20, however, that the firm is suspending its drive for CWIP and instead is focusing on its new partnership with Westinghouse.

Greenhouse gases by the way

Even so, opponents of the effort to bring SMRs to Missouri lined up to sound off. The Union of Concerned Scientists (UCS) told the Kansas City Star that the new KCP&L 850-MW coal-fired power plant cost $2 billion, or $2,350/Kw-about half the estimated price of the Westinghouse SMR at $5,000/Kw.

Even so, opponents of the effort to bring SMRs to Missouri lined up to sound off. The Union of Concerned Scientists (UCS) told the Kansas City Star that the new KCP&L 850-MW coal-fired power plant cost $2 billion, or $2,350/Kw-about half the estimated price of the Westinghouse SMR at $5,000/Kw.

Ironically, Ellen Vancko, the UCS spokesperson, said that natural gas plants might be cheaper and faster to build. The issue of greenhouse gas emissions wasn't mentioned in the report of her remarks.

Crowded field for DOE dollars

Competition to the bid by Westinghouse to win the DOE money will most likely come from other developers of SMRs using light water reactor technology.

Babcock & Wilcox is developing a 180-MW unit and has an agreement for cost-shared licensing and development with the Tennessee Valley Authority for two units at the utility's Clinch River site in Tennessee. B&W already has its own manufacturing supply chain in Ohio and Indiana.

NuScale recently announced it would develop a unit for testing and licensing purposes at the DOE's Savannah River Site. The DOE is not providing any money for the project, which will operate as a paying tenant at the lab. NuScale is partnering with NuHub, a South Carolina economic development organization to pursue the new build.

Further afield there are several efforts to develop fast reactors as SMRs, including Hyperion, which recently went through a management reorganization and re-branded itself as Gen4 Energy. It is working with a venture capital firm in Denver to commercialize a 25-MW design first developed at Los Alamos National Laboratory.

The DOE says that it will make a decision by September 2012 on how it will award the funds. While the agency has the first of five years of funding in hand, future funding will depend on the decisions in appropriation bills of a deficit-minded Congress. The outcome of the presidential election and possible changes in the House and Senate will all play in the mix to determine whether the DOE will be able to deliver on a five-year funding commitment.

__________________

Dan Yurman publishes Idaho Samizdat, a blog about nuclear energy, and is a frequent contributor to ANS Nuclear Cafe.