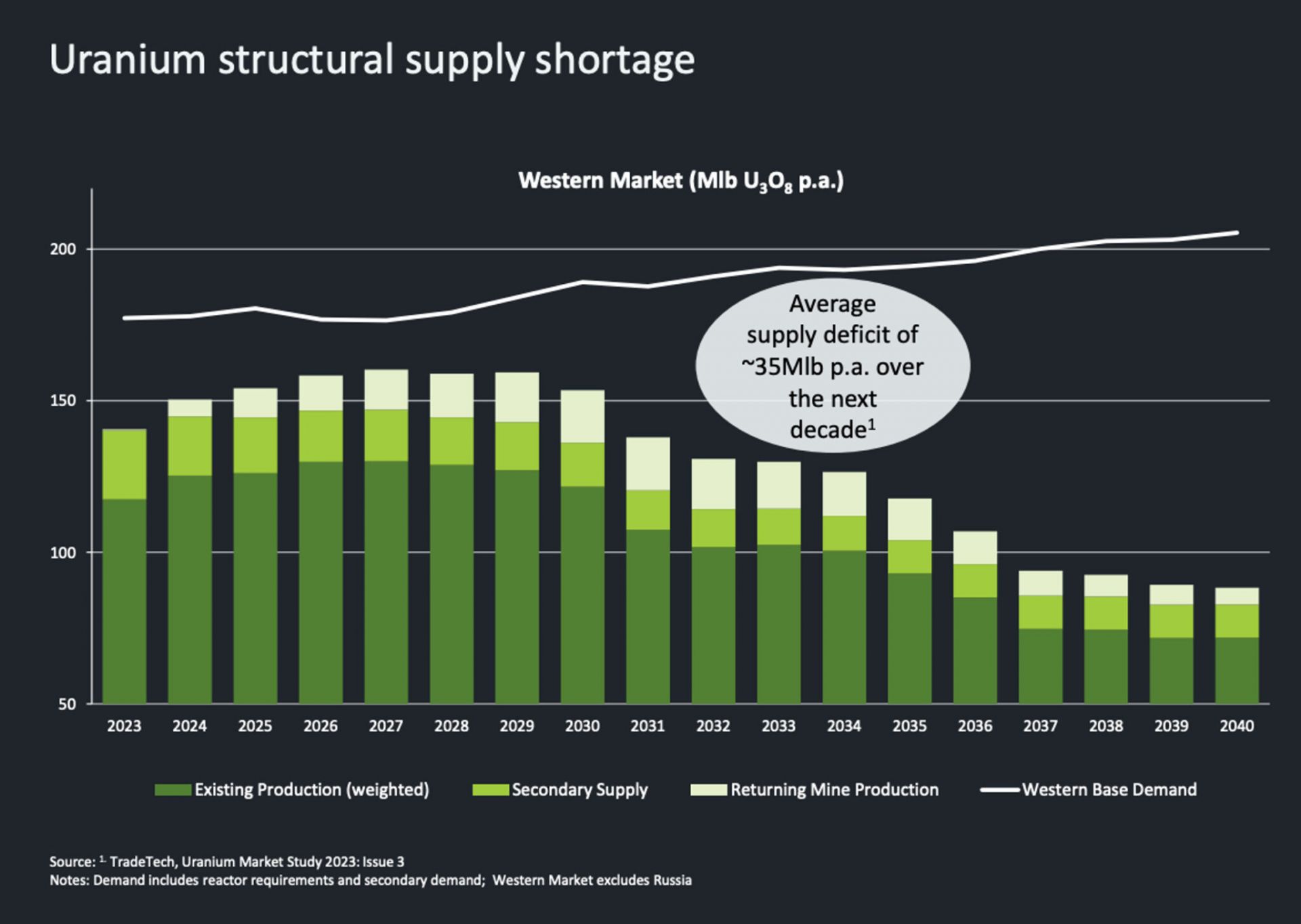

[Click to see full graphic] Western base demand (white line) for uranium will continue to outpace the combined existing production (dark green), secondary supply (middle green), and returning mine production (light green) through 2040, according to projections. (Image: Paladin Energy)

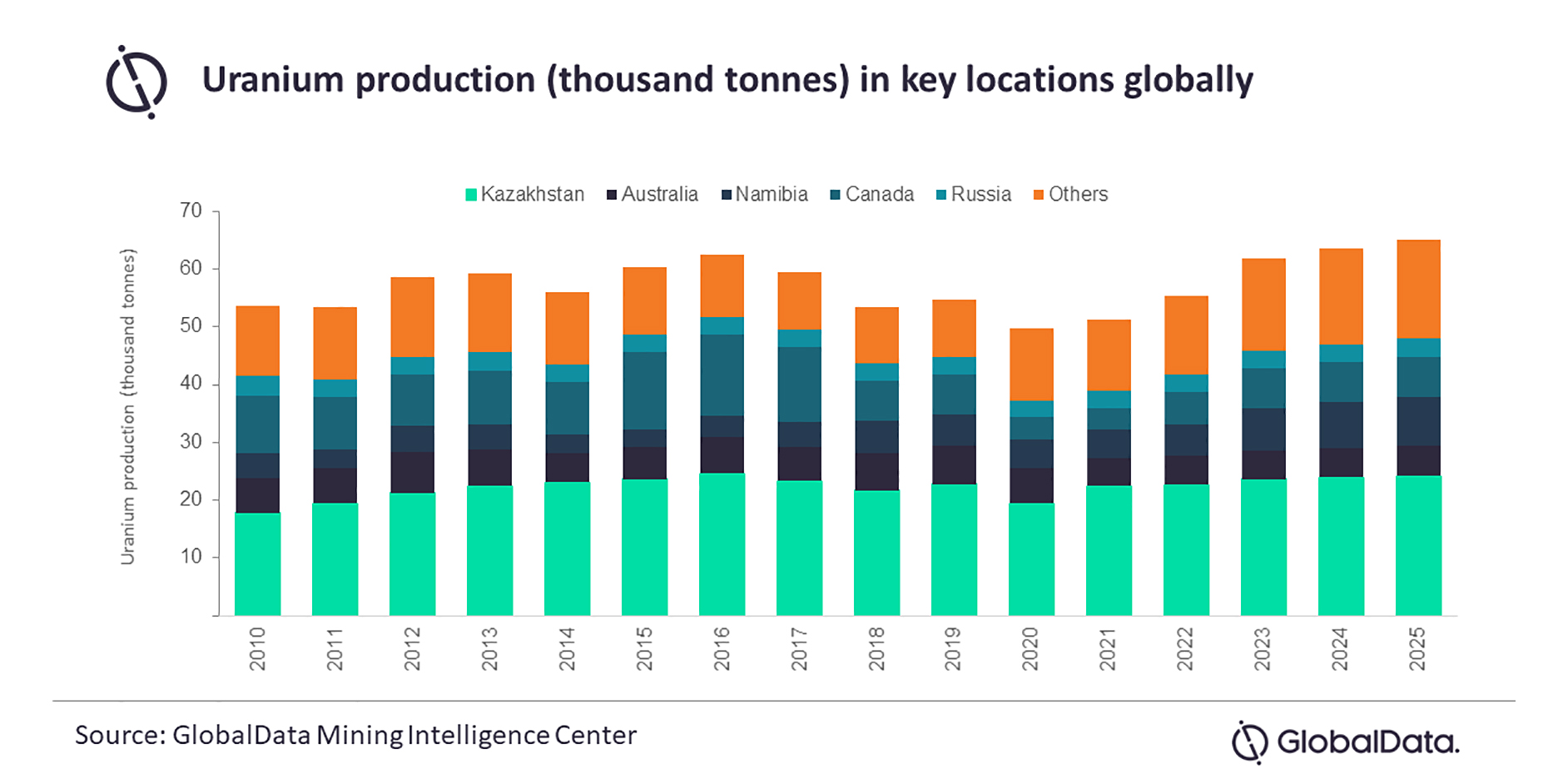

Investors continue to be bullish on uranium, according to a number of recent news reports. Stockhead recently trumpeted, “Uranium has started 2024 the same way it ended 2023—like a bull in a china shop. Spot prices are now agonizingly close to US$100/lb for the first time since 2008, with term pricing not far behind.” Similarly, Mining.com noted, “The spot price of uranium continues to rise, boosted by pledges to triple nuclear power by mid-century, supply hiccups from producers such as Cameco . . . , and the looming threat of a ban on Russian exports to the West.”

Various officials (back row) look on at the fuel supply contract signing in Sofia, Bulgaria. Front row, from left: Angie Darkey, Uranium Asset Management’s managing director; Boris Schucht, Urenco CEO; Tim Gitzel, Cameco president and CEO; and Aziz Dag, Westinghouse senior vice president of global BWR & VVER fuel business.

Canada’s Cameco and U.K.-based Urenco last week jointly announced the signing of agreements to become part of a Westinghouse-led fuel supply chain for Bulgaria’s Kozloduy nuclear power plant. (Also included in the partnership is Uranium Asset Management.)

From left: David Piccini, Ontario’s minister of environment, conservation, and parks; Mike Rencheck, president and CEO, Bruce Power; Tim Gitzel, president and CEO, Cameco; and Todd Smith, Ontario’s minister of energy. (Photo: Bruce Power)

Canadian firms Cameco and Bruce Power have announced a 10-year extension of their long-term exclusive nuclear fuel supply arrangements, securing power generation from the eight-unit 6,507-MWe Bruce nuclear plant through 2040.

Cameco headquarters in Saskatoon, Saskatchewan, Canada. (Photo: Cameco)

Five years after bankruptcy, Pennsylvania-based Westinghouse is being sold again, this time with a 49 percent share going to Cameco Corp., the front-end uranium mining, milling, and conversion company headquartered in Saskatchewan, Canada. Cameco and Brookfield Business Partners, based in Toronto, Ontario, announced the deal yesterday. Once it closes as expected, in the second half of 2023, Brookfield Renewable Partners and other Brookfield institutional partners will own a 51 percent interest in a consortium with Cameco.

Mining at McArthur River takes place between 530 and 640 meters belowground. (Photo: Cameco)

Citing “improving market sentiment,” Tim Gitzel, president and chief executive officer of the Canadian uranium mining company Cameco, announced on February 9 the planned restart of operations at the McArthur River mine in Saskatchewan.