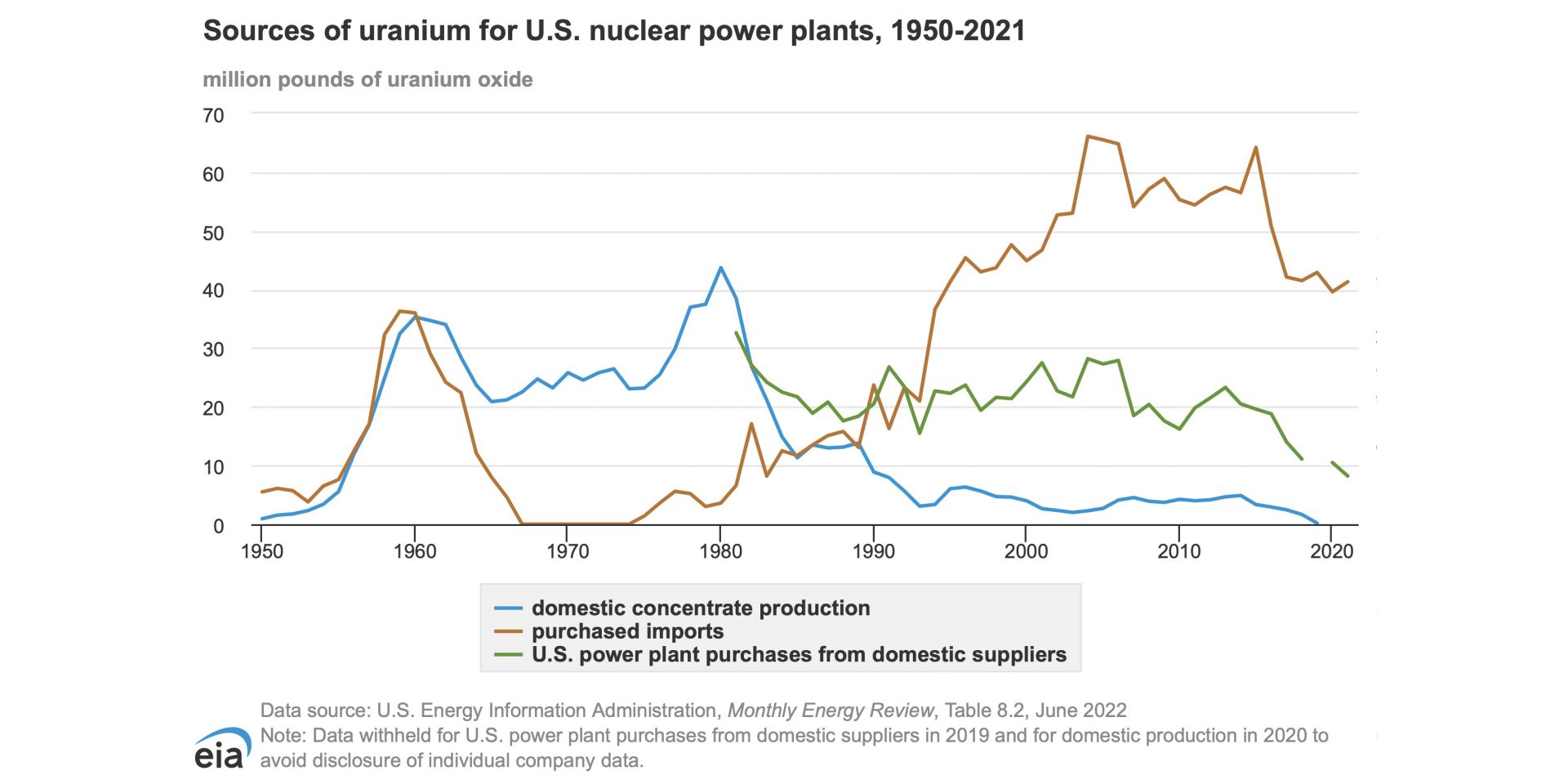

This chart from the EIA shows sources of uranium for U.S. nuclear power plants, 1950-2021. In 2020, according to the chart, 39.60 million pounds of uranium oxide was imported for the domestic nuclear power plant fleet. (Credit: Energy Information Agency)

The naturalist John Muir is widely quoted as saying, “When we try to pick out anything by itself, we find it hitched to everything else in the Universe.” While he was speaking of ecology, he might as well have been talking about nuclear fuel.

At the moment, by most accounts, nuclear fuel is in crisis for a lot of reasons that weave together like a Gordian knot. Today, despite decades of assertions from nuclear energy supporters that the supply of uranium is secure and will last much longer than fossil fuels, the West is in a blind alley. We find ourselves in conflict with Russia with ominous implications for uranium, for which Russia holds about a 14 percent share of the global market, and for two processes that prepare uranium for fabrication into reactor fuel: conversion (for which Russia has a 27 percent share) and enrichment (a 39 percent share).

NNSA administrator Jill Hruby (left) holds up the signed MOU on HEU conversion during the agency’s virtual meeting with Japan’s MEXT. (Credit: NNSA)

The Department of Energy’s National Nuclear Security Administration (NNSA) has signed a memorandum of understanding with Japan’s Ministry of Education, Culture, Sports, Science, and Technology (MEXT). The MOU describes their commitment to convert the Kindai University Teaching and Research Reactor (UTR-KINKI) from high-enriched uranium fuel to low-enriched uranium fuel. The nuclear nonproliferation–related agreement also calls for the secure transport of all the HEU to the United States for either downblending to LEU or disposition.

(Click photo to enlarge) One of 16 AC100M gas centrifuges built by Centrus Energy for HALEU production in Piketon, Ohio. (Photo: Centrus Energy)

For years, pressure has been building for a commercial path to a stable supply of high-assay low-enriched uranium (HALEU)—deemed essential for the deployment of advanced power reactors—but advanced reactor developers and enrichment companies are still watching and waiting. In contrast, the uranium spot price soared after Sprott Physical Uranium Trust, a Canadian investment fund formed in July, began buying up U3O8 supplies, causing the price to increase over 60 percent, topping $50 per pound for the first time since 2012. Fueled by growing acknowledgment that nuclear power is a necessary part of a clean energy future, uranium is the focus of attention from Wall Street to Capitol Hill.

The interior of the process building at the American Centrifuge Plant in Piketon, Ohio, where Centrus Energy plans to operate a HALEU demonstration cascade by June 2022. (Photo: Centrus Energy)

Advanced reactor cores are being designed for higher efficiencies and longer lifetimes, but to get there, they need high-assay low-enriched uranium (HALEU).

Enriched to between 5 and 19.75 percent fissile U-235, HALEU is packed with nuclear potential. It can be used as a feedstock for the demonstration of new fuel designs, from uranium alloys to ceramic pellets and liquid fuels. Those fuels can enable advanced reactor and microreactor demonstrations. Operating light-water reactors could potentially transition to HALEU uranium oxide fuels for extended operating cycles and improved plant economics.