French nuclear plant lowers output due to hot river water

Électricité de France reduced power production by 1 gigawatt on Friday at its Golfech nuclear plant, citing high water temperatures on the Garonne River.

A message from Electrical Builders, Ind.

America’s Top Performing Nuclear Plants Rely on Electrical Builders, Industries to Expand and Extend the Life of Their Critical Electrical Assets

Électricité de France reduced power production by 1 gigawatt on Friday at its Golfech nuclear plant, citing high water temperatures on the Garonne River.

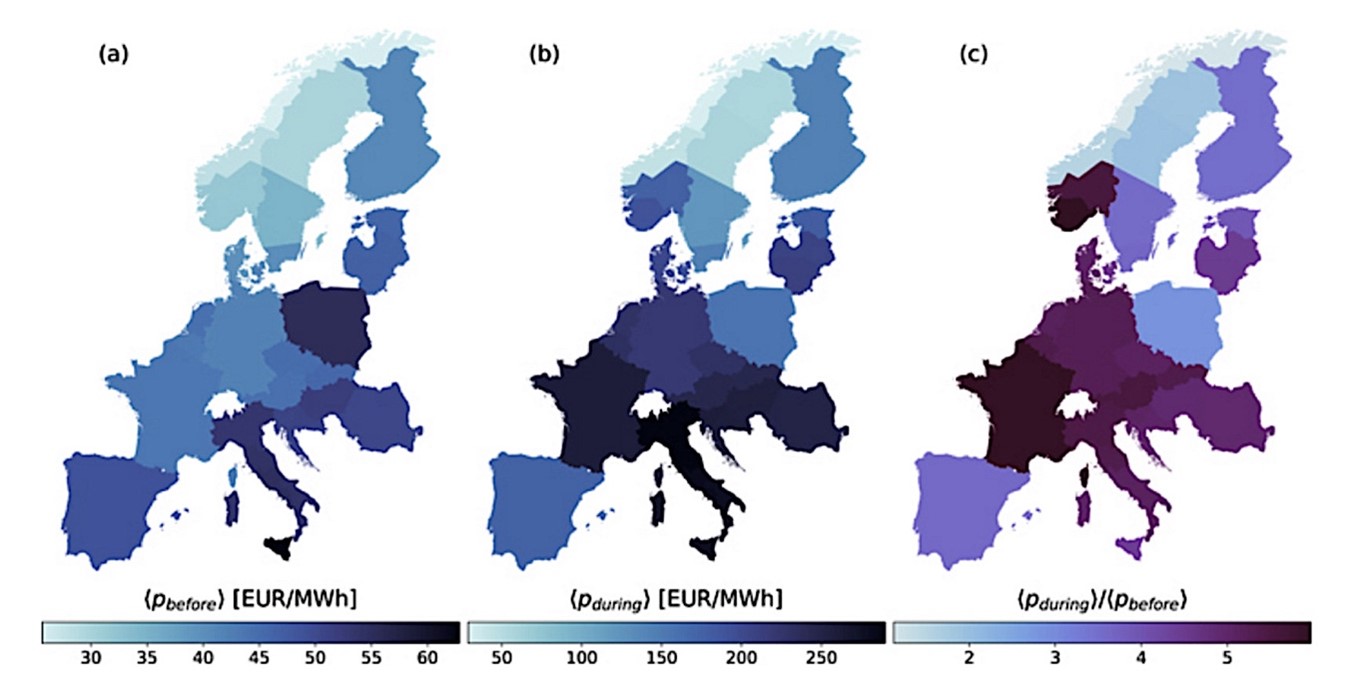

A statistical analysis of the factors behind the 2021–22 energy crisis in Europe is the subject of the article “Patterns and correlations in European electricity prices,” published in the journal Chaos: An Interdisciplinary Journal of Nonlinear Science. The study—conducted by researchers at the Institute for Energy and Climate Research at Forschungszentrum Jülich and the University of Cologne, both in Germany, and the Norwegian University of Life Sciences—describes reasons for the surge in energy prices that go beyond the commonly cited cause of Russia’s invasion of Ukraine.

French nuclear developer Framatome is slated to deliver key equipment for Sizewell C Ltd.’s two large reactors planned for the United Kingdom’s Suffolk coast.

The agreement, reportedly worth multiple billions of euros, was announced this week and will involve Framatome from the design phase until commissioning. The company also agreed to a long-term fuel supply deal. Framatome is 80.5 percent owned by France’s EDF and 19.5 percent owned by Mitsubishi Heavy Industries.

According to a new report by the European energy analysis firm Montel EnAppSys, France was “comfortably” the biggest net exporter of energy in Europe throughout 2023, with its export totals being 48.7 TWh more than its import totals. In second place in Europe was Sweden, with 28.6 TWh more in exports than imports.

A fire this past weekend at Chinon nuclear power plant in France forced two reactors to be shut down. According to initial reports, a transformer in a nonnuclear sector of Unit 3 caught fire.

The incident occurred February 10 in the early morning hours, local time, and the fire was quickly extinguished.

A proposed energy bill that the French government is scheduled to consider in early February is generating a great deal of controversy. If approved by the cabinet, the bill will go next to lawmakers in parliament for their consideration. However, the wording of the draft bill has been going through changes due to a controversy over nuclear energy versus renewables.

Early draft: A draft of the bill released on January 8 seemed to prioritize nuclear energy over renewable energy sources, including solar and wind. According to a January 9 report by France 24, the bill asserted “the sustainable choice of using nuclear energy as a competitive and carbon-free” source of electricity, and it set specific goals for nuclear energy, such as the construction of between six and 14 new nuclear reactors as a crucial step toward meeting climate change goals.

As Spain prepares to shutter its fleet of seven nuclear power plants, France considers adding more than 14 new ones.

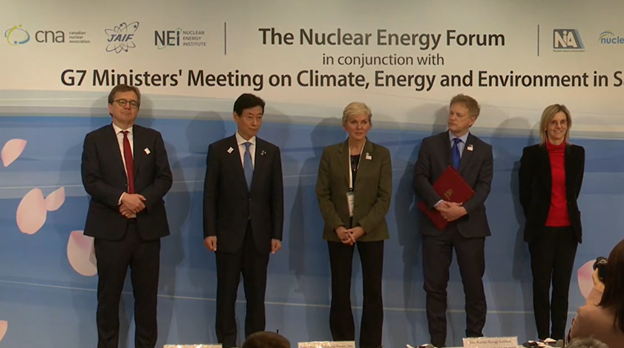

Leaders of five nations that collectively represent 50 percent of the world’s uranium conversion and enrichment capacity—the United States, Canada, Japan, France, and the United Kingdom—are making a habit of meeting on the sidelines of global climate talks to pledge their commitment to securing the nuclear fuel supply chain. On December 7 at the Net Zero Nuclear Summit—an event held in Dubai, United Arab Emirates, during the UN Climate Change Conference, or COP28—representatives of those nations announced plans to “mobilize at least $4.2 billion” in government and private investment in enrichment and conversion capacity. The commitment expands on an initial civil nuclear fuel security agreement that the so-called Sapporo 5 reached in April 2023, when they met (as now, on the sidelines) during a G7 Ministers’ Meeting on Climate, Energy, and Environment in Sapporo, Japan.

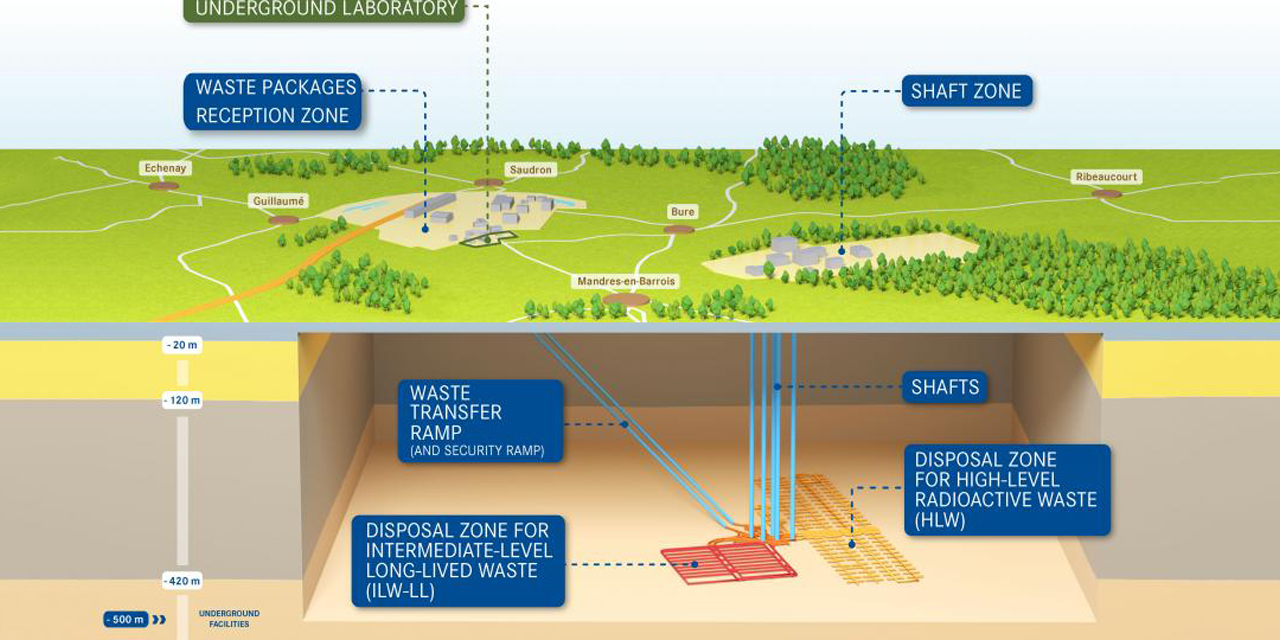

Outside my office, there is a display case filled with rock samples from all over the world. It contains a disk of translucent, orange salt from the Waste Isolation Pilot Plant near Carlsbad, N.M.; a core of white-and-bronze gneiss from the site of the future deep geologic repository in Eurajoki, Finland; several angular chunks of fine-grained, gray claystone from the underground research laboratory at Bure, France; and a piece of coarse-grained granite from the underground research tunnel in Daejeon, South Korea.

Having deemed the application admissible, France’s nuclear safety authority, Autorité de sûreté nucléaire (ASN), will undertake a technical appraisal of Andra’s application to construct the Cigéo deep geological disposal facility for radioactive waste.

A civil nuclear fuel security agreement between the five nuclear leaders of the G7—announced on April 16 on the sidelines of the G7 Ministers’ Meeting on Climate, Energy and Environment in Sapporo, Japan—establishes cooperation between Canada, France, Japan, the United Kingdom, and the United States to flatten Russia’s influence in the global nuclear fuel supply chain.

Although the first quarter of the year saw some of the French nuclear fleet return to service, it was not at the rate originally anticipated, according to data analysis company EnAppSys. France’s nuclear availability, the company noted, was expected to reach a maximum of 50 GW by the middle of the first quarter, but that goal was not reached due to several reasons, including the need for additional repairs and maintenance when stress corrosion cracking first appeared in several reactors last year. Workforce strikes at nuclear operator Électricité de France also led to widespread employee walkouts from nuclear power plants.

Attracting more than 2,000 attendees, the 2023 Waste Management Symposia was held February 26–March 2 in Phoenix, Ariz. For many, this year’s conference was a return to business as usual, with a packed exhibit hall and well-attended technical session, as the upheaval brought about by the pandemic that began three years earlier seemed a thing of the pasts. Not that those who gathered in Phoenix threw any caution to the unseasonably cold and rainy winds that descended across Arizona this year.

Steven Arndt

president@ans.org

As president of ANS, I am frequently asked, if it is the American Nuclear Society, why are you concerned with what is happening outside the United States? I usually start with a simple response: Although ANS is incorporated in the U.S., the Society has local and student sections as well as members in a number of other countries and is involved with key issues throughout the world. Although this is true—we have seven international sections and four international student sections, and about 10 percent of our membership is from other countries—it is only part of the story. From the very beginning, nuclear science and technology has been an international collaboration. The U.S. certainly can claim leadership in a lot of the advances in the research and industrial applications of our technology, but most of our advances have been based on active collaboration both within and across borders.

During my tenure, I have seen this firsthand. As travel has opened up throughout the world in the past year, I have visited the Latin American and French sections of ANS, as well as the University of Puerto Rico student section, and I have attended a number of ANS-sponsored technical meetings throughout the world.

As a direct result of the war in Ukraine, several countries have changed their policies on nuclear energy—even those with long-standing nuclear phase-out plans. This February will mark one year since Russia began its invasion of Ukraine, leading to ongoing war and turning pandemic-era energy shortages into a global energy crisis. Spiking gas prices and concerns about electricity supply during the cold winter months have thrown many governments into a frenzy as they try to ease the impact on their citizens.

Countries in the process of phasing out their nuclear power had been prepared to increase their reliance on natural gas. But as Russia supplies 40 percent of the European Union’s natural gas, nations with no reliable alternative now face sky-high energy prices—even energy poverty. Across Europe and beyond, nuclear power plants slated for permanent closure have been given second chances to shore up energy supply. Nuclear power has also claimed a bigger spotlight in countries’ strategies for energy independence.

A picture of the state of the global nuclear energy industry has been painted in a recent article by Dawn Stover, a contributing editor at the Bulletin of the Atomic Scientists. Stover based her comments on The World Nuclear Industry Status Report 2022 (WNISR), published on October 5. The report refers to itself as an “independent assessment of nuclear developments in the world” compiled by an international team.

A picture of the state of the global nuclear energy industry has been painted in a recent article by Dawn Stover, a contributing editor at the Bulletin of the Atomic Scientists. Stover based her comments on The World Nuclear Industry Status Report 2022 (WNISR), published on October 5. The report refers to itself as an “independent assessment of nuclear developments in the world” compiled by an international team.

What’s in the WNISR: In the report, 10 countries—China, Finland, France, Germany, India, Japan, South Korea, Taiwan, the United Kingdom, and the United States—receive a focused analysis based on specific issues affecting their nuclear businesses. Other chapters deal with the statuses of Fukushima, decommissioning in general, potential newcomer countries to nuclear power, and small modular reactors. For the first time, the WNISR also contains a chapter on nuclear power and war.

As energy security and environmental concerns prompt some countries to increase their reliance on nuclear energy or become first-time adopters of the technology, the U.S. government must decide whether it will offer financing for reactor exports—a move that poses financial risks but could create jobs, address global climate and energy security challenges, and limit Chinese and Russian influence. A new report released on August 25 by the Center on Global Energy Policy at Columbia University’s School of International and Public Affairs, Comparing Government Financing of Reactor Exports: Considerations for U.S. Policy Makers, digs into the history of nuclear reactor financing and delivers recommendations for U.S. policymakers.

As energy security and environmental concerns prompt some countries to increase their reliance on nuclear energy or become first-time adopters of the technology, the U.S. government must decide whether it will offer financing for reactor exports—a move that poses financial risks but could create jobs, address global climate and energy security challenges, and limit Chinese and Russian influence. A new report released on August 25 by the Center on Global Energy Policy at Columbia University’s School of International and Public Affairs, Comparing Government Financing of Reactor Exports: Considerations for U.S. Policy Makers, digs into the history of nuclear reactor financing and delivers recommendations for U.S. policymakers.

Matt Bowen, research scholar at the center and the report’s lead author, told Nuclear News, “Given how important financing is to countries considering new reactor construction, as well as the competition that U.S. vendors face from foreign state-owned entities, Congress and the White House should both focus attention on the issue, including policy options to increase U.S. competitiveness.”

General Atomics’ Magnet Technologies Center in Poway, Calif., played host last week to French ambassador Philippe Étienne, the company announced June 16. During the visit, which was hosted by Vivek Lall, chief executive of the General Atomics Global Corporation, Étienne viewed ITER central solenoid modules—all destined for shipment to France—in several stages of the fabrication process.

“General Atomics and French organizations have a strong relationship in both the defense and energy sectors, as well as in the unmanned field, that meet both France’s and the United States’ important interests,” Étienne remarked during his visit.

Bloomberg recently reported that nuclear power production in France declined to its lowest level in almost two years in April, with power output during that month falling to 21.7 TWh. The decline occurred as Électricité de France (EDF), one of the country’s major energy suppliers, dealt with long-term inspection-and maintenance-related halts to the operation of many of its 56 domestic nuclear reactors.

Europeans are taking resolute steps to reduce their output of climate-changing gases, but some countries are moving in the wrong direction.

Europeans are taking resolute steps to reduce their output of climate-changing gases, but some countries are moving in the wrong direction.

Many countries are adding solar and wind, which are low-carbon energy sources. Some have moved to biomass, the value of which as a climate cure is not clear. A few are adding reactors, while others are defining nuclear as dirty energy and natural gas as “clean” and are changing their generation mix accordingly.