Uranium yellowcake is used in the preparation of uranium fuel that is used in nuclear reactors. (Photo: DOE)

On May 13, President Biden signed the Prohibiting Russian Uranium Imports Act, unlocking the $2.72 billion that Congress conditionally appropriated in March to increase production of low-enriched uranium (LEU) and high-assay low-enriched uranium (HALEU).

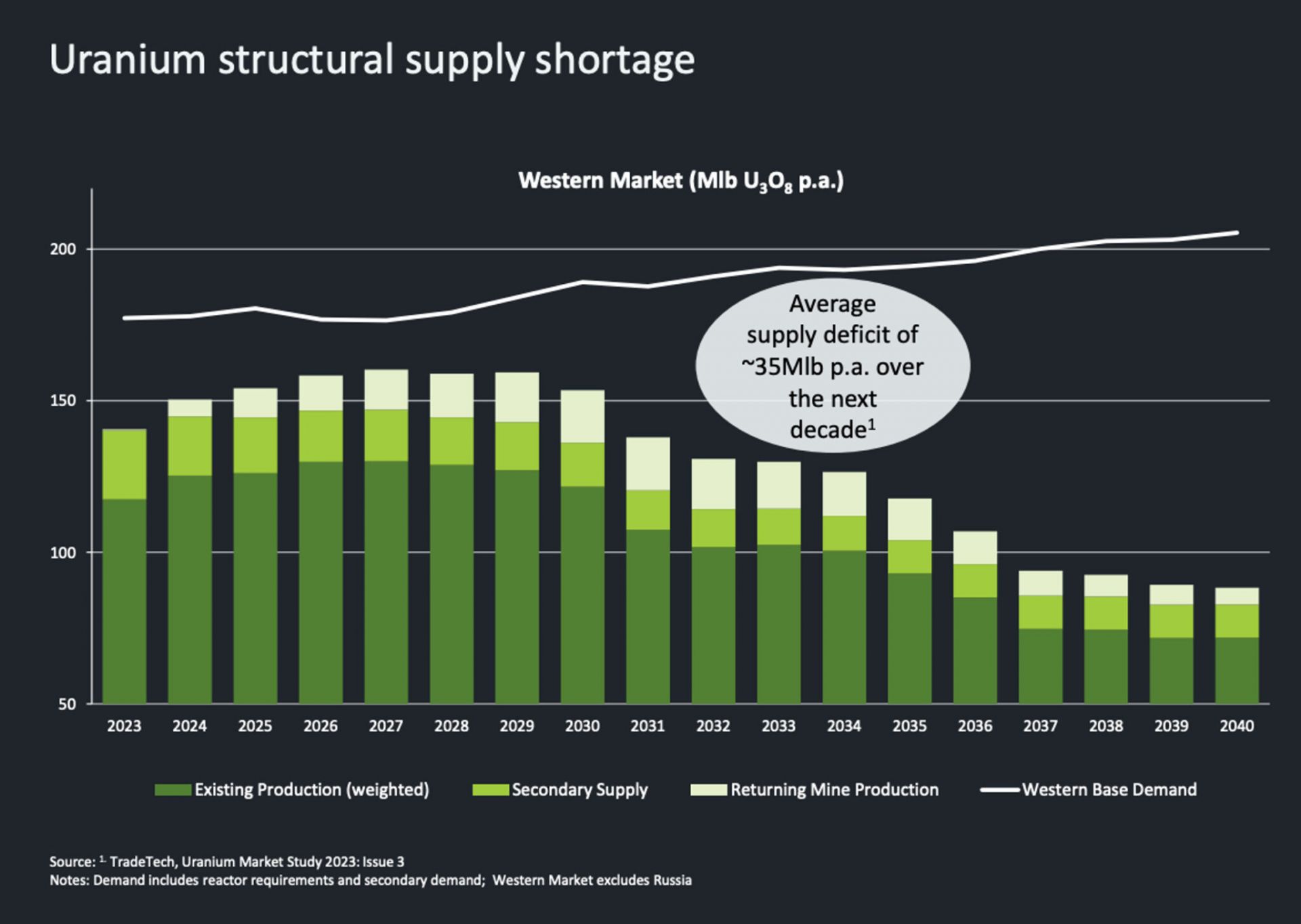

[Click to see full graphic] Western base demand (white line) for uranium will continue to outpace the combined existing production (dark green), secondary supply (middle green), and returning mine production (light green) through 2040, according to projections. (Image: Paladin Energy)

Investors continue to be bullish on uranium, according to a number of recent news reports. Stockhead recently trumpeted, “Uranium has started 2024 the same way it ended 2023—like a bull in a china shop. Spot prices are now agonizingly close to US$100/lb for the first time since 2008, with term pricing not far behind.” Similarly, Mining.com noted, “The spot price of uranium continues to rise, boosted by pledges to triple nuclear power by mid-century, supply hiccups from producers such as Cameco . . . , and the looming threat of a ban on Russian exports to the West.”

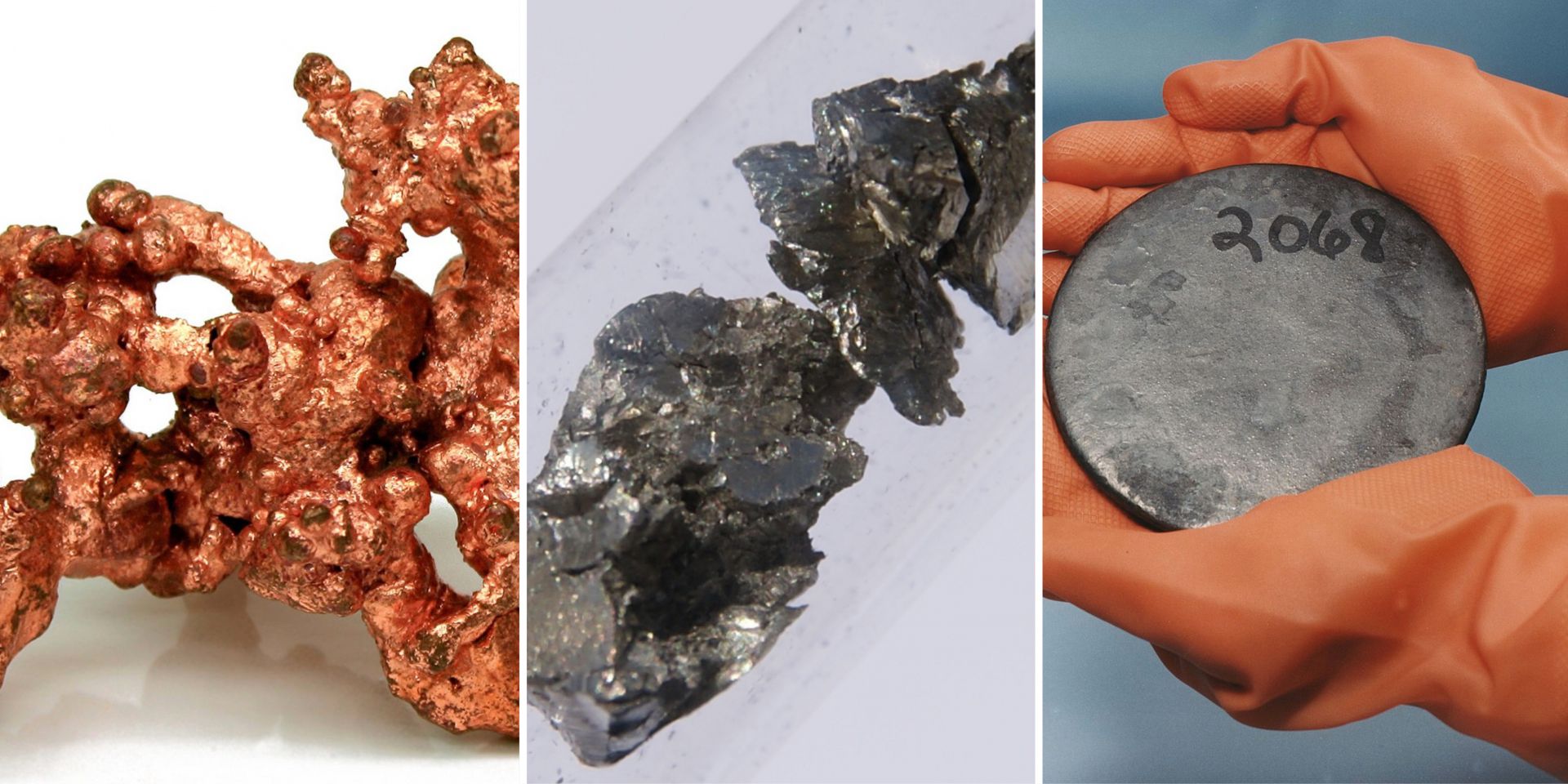

Three of the USGS's critical minerals: (Left to right) A piece of native copper recovered by dissolution of the host rock (Photo: Jonathan Zander); A sample of praseodymium in a vial of argon (Photo: Jurii/Wikimedia Commons); A billet of high-enriched uranium that was recovered from scrap processed at the DOE’s Y-12 National Security Complex in Oak Ridge, Tenn (Photo: DOE).

Last year, the U.S. Geological Survey (USGS) released its 2022 list of 50 minerals that are essential to the function of our society, especially the economy and national security. Whether it’s indium for LCD screens and aircraft wind shielding, cobalt for iPhones, uranium for nuclear reactors and munitions, rare earth elements for wind turbine magnets, lithium for rechargeable batteries, or tantalum for electronic components, if we do not have an ample supply, bad things will happen.

March 14, 2023, 9:39AMEdited March 14, 2023, 9:38AMNuclear News In this screenshot from a video recording of the hearing, Huff, Wagner, and Dominguez answer a series of questions from Sen. Manchin

“Right now, our country is deficient in nearly every aspect of the fuel cycle. This must change and it must change quickly,” said Sen. Joe Manchin (D., W.V.), chairman of the Senate Committee on Energy and Natural Resources (ENR), as he opened a Full Committee Hearing to Examine the Nuclear Fuel Cycle on March 9. “Whether it is uranium mining, milling, conversion, enrichment, nuclear fuel fabrication, power generation, or nuclear waste storage and disposal, there is much work to be done, starting with conversion and enrichment. Simply put, Russia dominates the global market, representing nearly half of the international capacity for both processes.”

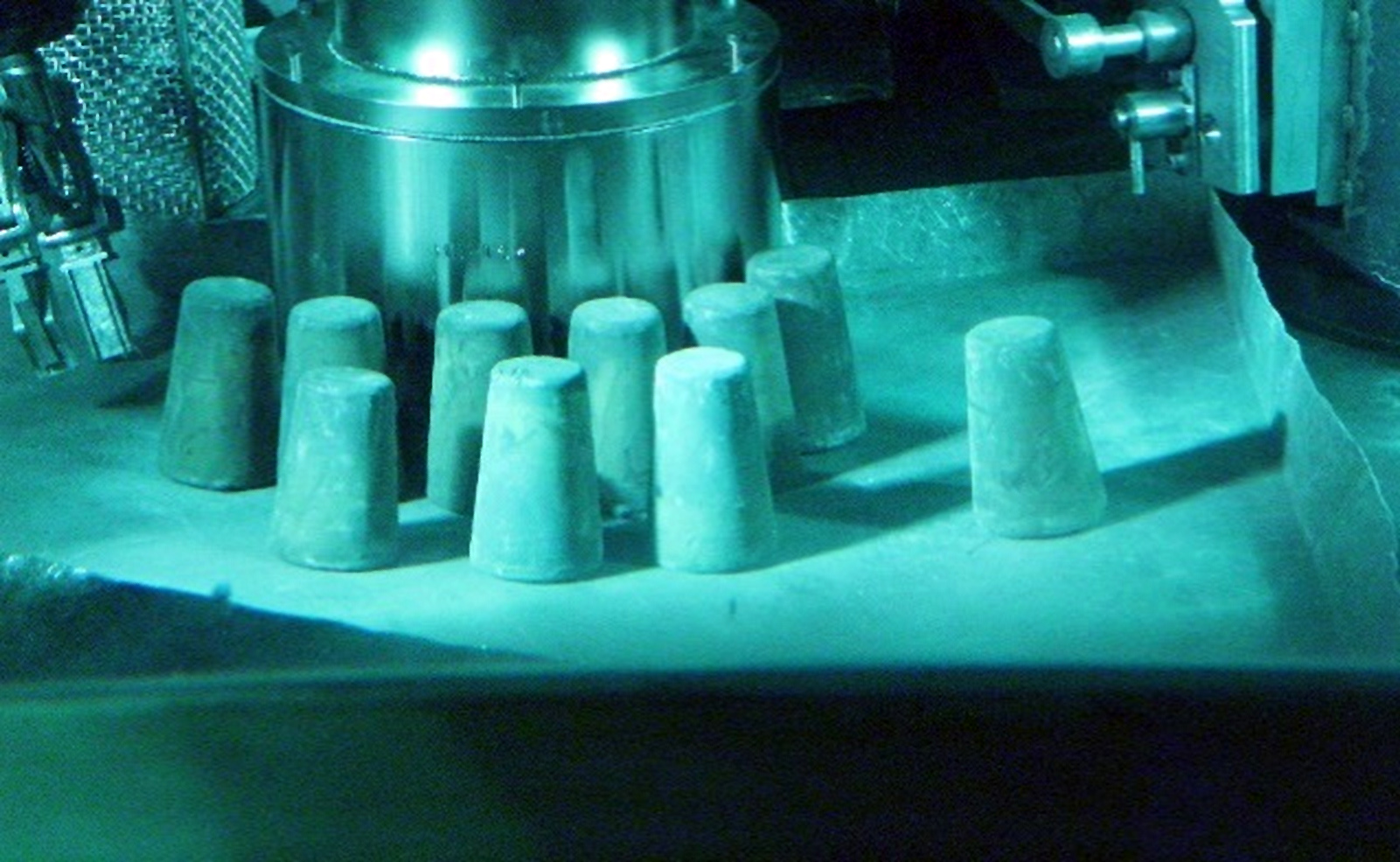

HALEU in the form of 1.5–3 kg reguli ready for fuel fabrication. (Photo: INL)

Those who welcomed the $700 million earmarked for high-assay low-enriched uranium (HALEU) supply in the Inflation Reduction Act of 2022 (IRA) in August have cause to celebrate again. The White House sent a supplemental appropriation request to Congress on September 2 that would provide more than double the IRA funds if passed—$1.5 billion—for the Department of Energy’s Office of Nuclear Energy to build a reliable supply of both low-enriched uranium for existing U.S. nuclear power plants and HALEU for the advanced reactors that will be built within the decade.

Mining at McArthur River takes place between 530 and 640 meters belowground. (Photo: Cameco)

Citing “improving market sentiment,” Tim Gitzel, president and chief executive officer of the Canadian uranium mining company Cameco, announced on February 9 the planned restart of operations at the McArthur River mine in Saskatchewan.