At NRC headquarters are (from left) UUSA’s Gerard Poortman, Wyatt Padgett, Lisa Hardison, and Paul Lorskulsint (seated), with the NRC’s James Downs (seated), Shana Helton, Kimyata Morgan-Butler, John Lubinski, and Johnathan Rowley. (Photo: Urenco USA)

Just one day after Urenco USA (UUSA) was picked by the Department of Energy as one of six contractors eligible to compete for future low-enriched uranium task orders, the Nuclear Regulatory Commission on December 11 formally approved the company’s license amendment request to boost uranium enrichment levels at its Eunice, N.M., enrichment facility to 10 percent fissile uranium-235—up from its current limit of 5.5 percent.

Uranium hexafluoride gas containers. (Photo: DOE)

The Department of Energy announced yesterday the six companies that it has selected to supply low-enriched uranium (LEU) from new domestic enrichment sources under future contracts for up to 10 years. The contract recipients are: Centrus Energy’s American Centrifuge Operating, General Matter, Global Laser Enrichment (GLE), Laser Isotope Separation Technologies (LIS Technologies), Orano Federal Services, and Urenco USA’s Louisiana Energy Services.

Representatives of Urenco, the United Kingdom, the United States, Germany, the Netherlands, and the IAEA gathered at Urenco’s Capenhurst site. (Photo: Urenco)

Uranium enricher Urenco welcomed representatives from the International Atomic Energy Agency to an August 19 event to mark the creation of an IAEA Centre of Excellence for Safeguards and Non-Proliferation at its Capenhurst, England, site. Representatives of the three nations with ownership stakes in Urenco—the United Kingdom, the Netherlands, and Germany—were joined by representatives from the United States, where Urenco also operates an enrichment plant. Urenco expects the new center to be fully operational in 2025.

The Capenhurst site in Cheshire, England. (Photo: Urenco)

The U.K. government this week announced a $245 million (£196 million) award to help Urenco build Europe’s first advanced reactor fuel manufacturing plant, which will be located in northwest England at the company’s Capenhurst site. Urenco, which is part-owned by the U.K. government, will cofund the project.

Representatives of OPG and its partners announced new contracts at the World Nuclear Exhibition in Paris. (Photo: X/@urencoglobal)

At the World Nuclear Exhibition in Paris this week, Ontario Power Generation announced contracts with Canadian, French, and U.S. companies to ensure a fuel supply for the first of four GE Hitachi Nuclear Energy BWRX-300 small modular reactors planned for deployment at OPG’s Darlington nuclear power plant.

A bank of Urenco centrifuges. (Photo: Urenco USA)

Urenco announced July 6 that it will expand enrichment capacity at its U.S. site in Eunice, N.M.—known as UUSA—by adding new centrifuge cascades to increase capacity by about 700 metric tons of separative work units per year, or a 15 percent increase, with the first new cascades coming on line in 2025.

Various officials (back row) look on at the fuel supply contract signing in Sofia, Bulgaria. Front row, from left: Angie Darkey, Uranium Asset Management’s managing director; Boris Schucht, Urenco CEO; Tim Gitzel, Cameco president and CEO; and Aziz Dag, Westinghouse senior vice president of global BWR & VVER fuel business.

Canada’s Cameco and U.K.-based Urenco last week jointly announced the signing of agreements to become part of a Westinghouse-led fuel supply chain for Bulgaria’s Kozloduy nuclear power plant. (Also included in the partnership is Uranium Asset Management.)

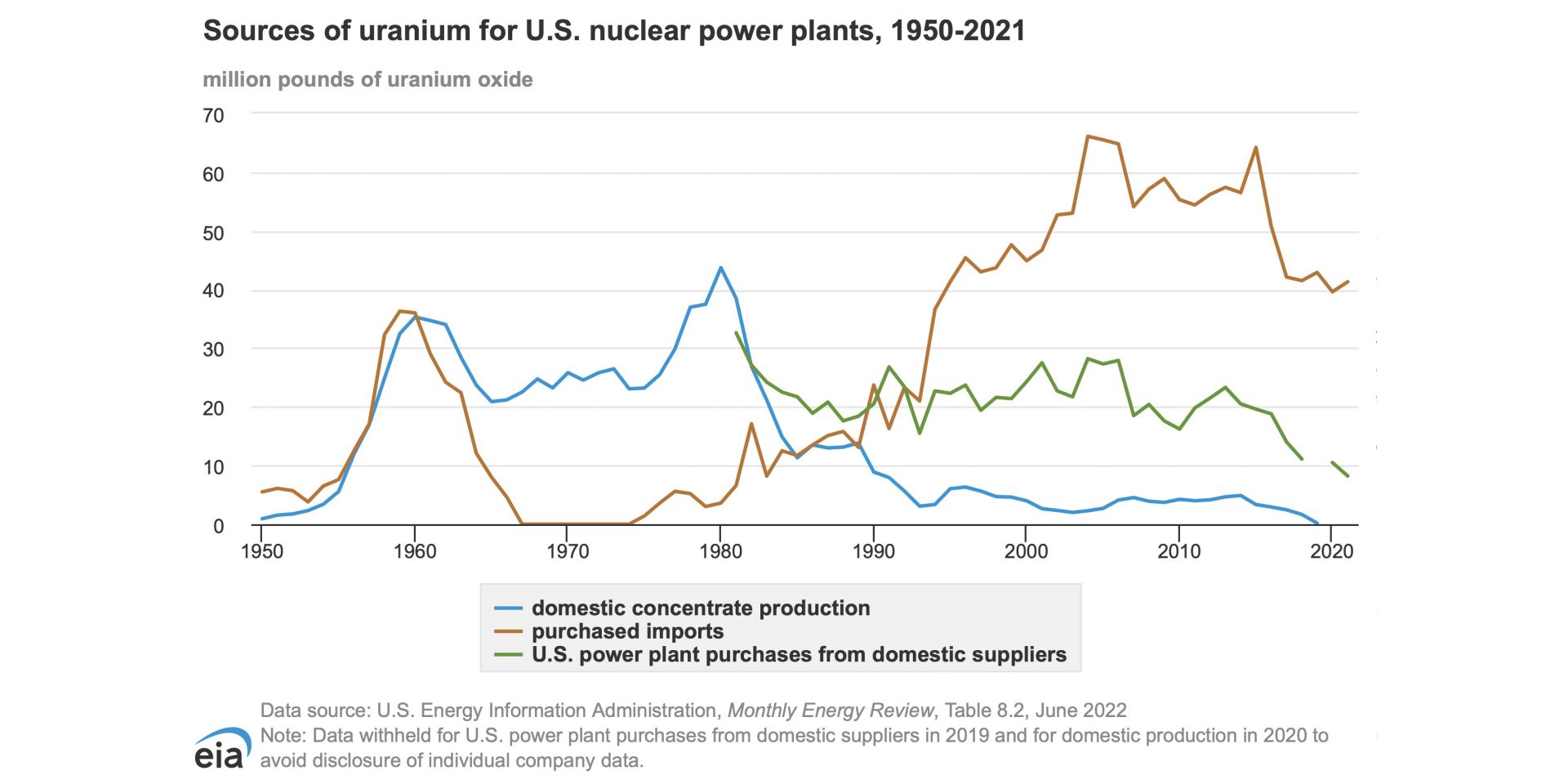

This chart from the EIA shows sources of uranium for U.S. nuclear power plants, 1950-2021. In 2020, according to the chart, 39.60 million pounds of uranium oxide was imported for the domestic nuclear power plant fleet. (Credit: Energy Information Agency)

The naturalist John Muir is widely quoted as saying, “When we try to pick out anything by itself, we find it hitched to everything else in the Universe.” While he was speaking of ecology, he might as well have been talking about nuclear fuel.

At the moment, by most accounts, nuclear fuel is in crisis for a lot of reasons that weave together like a Gordian knot. Today, despite decades of assertions from nuclear energy supporters that the supply of uranium is secure and will last much longer than fossil fuels, the West is in a blind alley. We find ourselves in conflict with Russia with ominous implications for uranium, for which Russia holds about a 14 percent share of the global market, and for two processes that prepare uranium for fabrication into reactor fuel: conversion (for which Russia has a 27 percent share) and enrichment (a 39 percent share).

From left: Christina Leggett (Booz Allen Hamilton), Morris Hassler (IB3 Global Solutions), Everett Redmond (Oklo), Andy Griffith (DOE-NE), Ben Jordan (Centrus), Stephen Long (GLE), and Magnus Mori (Urenco).

Whether commercial demand for high-assay low-enriched uranium (HALEU) fuel ultimately falls at the high or low end of divergent forecasts, one thing is certain: the United States is not ready to meet demand, because it currently has no domestic HALEU enrichment capacity. But conversations happening now could help build the commercial HALEU enrichment infrastructure needed to support advanced reactor deployments. At the 2022 American Nuclear Society Winter Meeting, representatives from three potential HALEU enrichers, the government, and industry met to discuss their timelines and challenges during “Got Fuel? Progress Toward Establishing a Domestic US HALEU Supply,” a November 15 executive session cosponsored by the Nuclear Nonproliferation Policy Division and the Fuel Cycle and Waste Management Division.

Participating in the forum were (from left) John Hopkins (NuScale Power), Renaud Crassous (EDF), Daniel Poneman (Centrus Energy), Adriana Cristina Serquis (CNEA), and Boris Schucht (Urenco).

The nuclear industry leaders assembled in Washington, D.C., last week to discuss small modular reactor supply chains agreed that lost generation capacity from the expected retirement of hundreds or thousands of coal power plants over the next decade—a cliff, in one panelist’s words—represents an opportunity that developers of SMRs and advanced reactors are competing to meet.

“I think in total 80 projects are ongoing,” said Boris Schucht, panel moderator and chief executive officer of Urenco Group, as he opened the forum. “Of course not all of them will win, and we will discuss today what is needed so that they can be successful.”

Almost two-thirds of 14- to 18-year-olds in the United Kingdom would consider a career in nuclear if they knew more about it, according to a new report,

Almost two-thirds of 14- to 18-year-olds in the United Kingdom would consider a career in nuclear if they knew more about it, according to a new report,