Executives from Westinghouse and Slovenské Elektrárne met in the Slovakian capital of Bratislava to sign the agreement to license and supply VVER-440 fuel assemblies. From left are Aziz Dag, senior vice president and managing director of Westinghouse Electric Sweden; Lukáš Maršálek, deputy director for the accounting, finance, and control department of Slovenské Elektrárne; Tarik Choho, Westinghouse president of nuclear fuel; and Branislav Strýček, director general of Slovenske Elektrárne. (Photo: Westinghouse)

In the latest example of Europe’s move away from its dependence on Russia for VVER reactor fuel, Westinghouse Electric Company on Friday signed a long-term agreement with Slovakia’s nuclear power plant operator, Slovenské Elektrárne, to license and supply VVER-440 fuel assemblies.

An aerial view of Westinghouse’s Springfields Fuel Fabrication Facility, near Preston, Lancashire, in northwestern England. (Photo: Westinghouse)

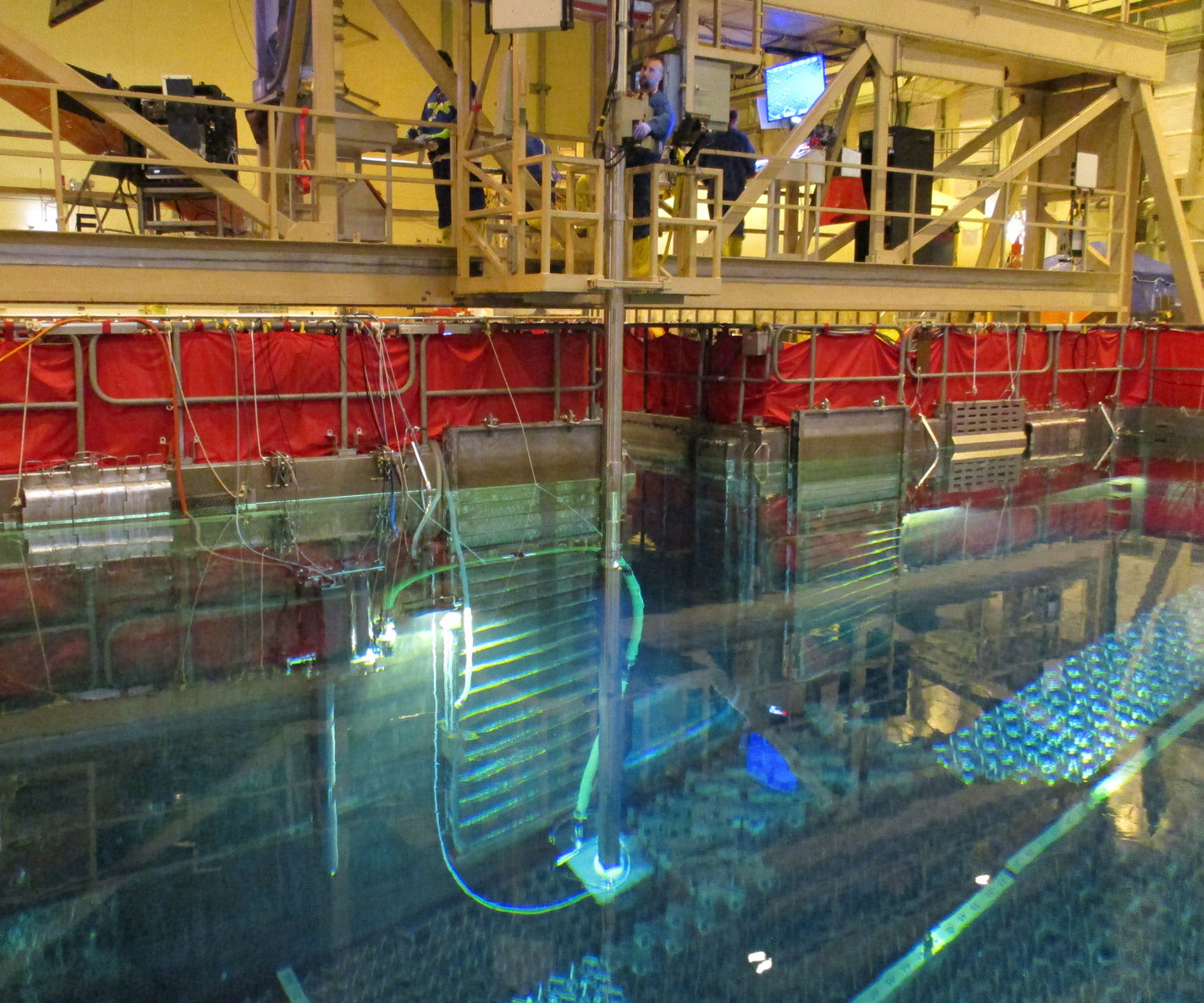

Through its now one-year-old Nuclear Fuel Fund, the U.K. government has awarded Westinghouse three grants to upgrade and expand the Springfields Fuel Fabrication Facility to support Britain’s next-generation nuclear reactors, the American-based company announced yesterday.

View of the machine controls electronics of Centrus’s HALEU demonstration cascade. (Photo: Centrus)

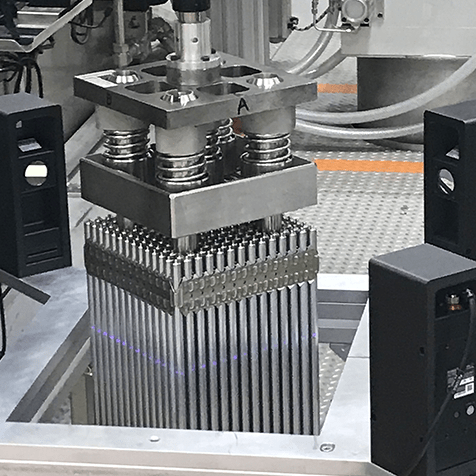

TerraPower and Centrus Energy Corp. announced on July 17 that they have signed a memorandum of understanding to “significantly expand their collaboration aimed at establishing commercial-scale, domestic production capabilities for high-assay, low-enriched uranium (HALEU)” to supply fuel for TerraPower’s first Natrium reactor. Nearly three years ago, TerraPower first announced plans to work with Centrus to establish commercial-scale HALEU production facilities. The two companies signed a contract in 2021 for services to help expedite the commercialization of enrichment technology at Centrus’s Piketon, Ohio, facility.

A bank of Urenco centrifuges. (Photo: Urenco USA)

Urenco announced July 6 that it will expand enrichment capacity at its U.S. site in Eunice, N.M.—known as UUSA—by adding new centrifuge cascades to increase capacity by about 700 metric tons of separative work units per year, or a 15 percent increase, with the first new cascades coming on line in 2025.

From left, Sophie Lemaire, Westinghouse senior vice president, EMEA & Asia PWR fuel; David Eaves, Westinghouse EHS&Q director and chief technical officer; Mark Hartley, EDF Energy managing director of generation; and David Tomblin, EDF Energy finance director of generation. (Photo: Westinghouse)

Westinghouse Electric Company has signed a contract extension with EDF Energy to supply fuel for the United Kingdom’s advanced gas-cooled reactor (AGR) fleet, the American firm announced yesterday.

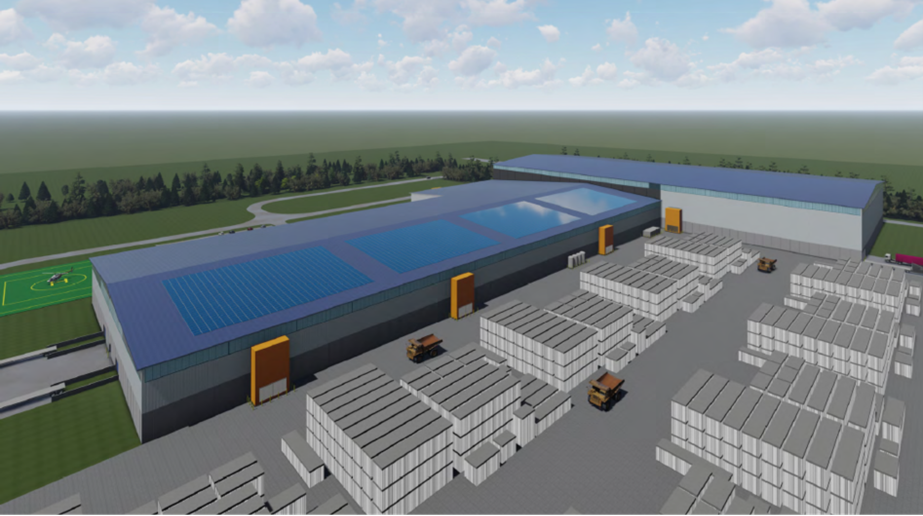

Concept art of the planned Gadsden, Ala., MMR assembly plant. (Image: Ultra Safe Nuclear)

Ultra Safe Nuclear (USNC) announced on June 21 that it has selected the city of Gadsden, Ala., to host a $232 million MMR assembly plant. Modules for the company’s high-temperature, gas-cooled and TRISO-fueled microreactor, dubbed the Micro-Modular Reactor (MMR), would be manufactured, assembled, and tested at the “highly automated facility” once it is in operation.

Centrus’s HALEU demonstration cascade. (Photo: Centrus Energy)

Centrus Energy announced yesterday that it has received Nuclear Regulatory Commission approval to introduce uranium hexafluoride into its 16-machine centrifuge cascade in Piketon, Ohio, following operational readiness reviews by the NRC. Centrus says it “remains on track to begin production of high-assay low-enriched uranium (HALEU) by the end of 2023.” The announcement follows a series of inspections at the American Centrifuge site in April 2023.

A Framatome operator fabricates U-Mo foils at CERCA. (Photo: Framatome)

Framatome is prepared to manufacture a novel molybdenum-uranium (U-Mo) fuel to extend the life and safe operation of the Forschungsreaktor München II (FRM II) research reactor in Germany. A new fuel supply—one that uses uranium enriched to less than 20 percent U-235—means the FRM II can continue to supply neutrons to industry and the scientific community. The fuel is “Europe’s low-enriched fuel with the highest density ever realized for research reactor operations,” according to Framatome’s April 27 announcement.

Various officials (back row) look on at the fuel supply contract signing in Sofia, Bulgaria. Front row, from left: Angie Darkey, Uranium Asset Management’s managing director; Boris Schucht, Urenco CEO; Tim Gitzel, Cameco president and CEO; and Aziz Dag, Westinghouse senior vice president of global BWR & VVER fuel business.

Canada’s Cameco and U.K.-based Urenco last week jointly announced the signing of agreements to become part of a Westinghouse-led fuel supply chain for Bulgaria’s Kozloduy nuclear power plant. (Also included in the partnership is Uranium Asset Management.)

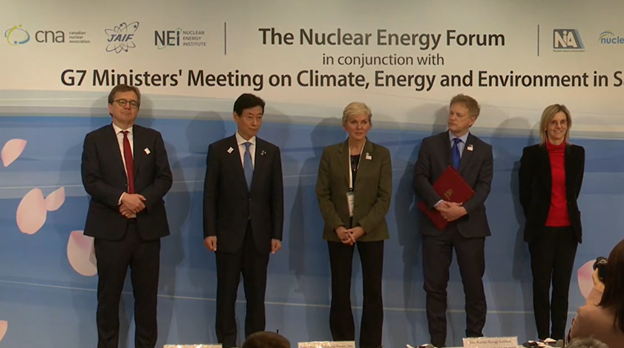

The ministers representing their respective nations as the statement on civil nuclear fuel cooperation was announced were (from left) Jonathan Wilkinson, minister of natural resources of Canada; Yasutoshi Nishimura, Japan’s minister of economy, trade, and industry; Jennifer Granholm, U.S. energy secretary; Grant Shapps, U.K. energy security secretary; and Agnes Pannier-Runacher, French minister for energy transition.

A civil nuclear fuel security agreement between the five nuclear leaders of the G7—announced on April 16 on the sidelines of the G7 Ministers’ Meeting on Climate, Energy and Environment in Sapporo, Japan—establishes cooperation between Canada, France, Japan, the United Kingdom, and the United States to flatten Russia’s influence in the global nuclear fuel supply chain.

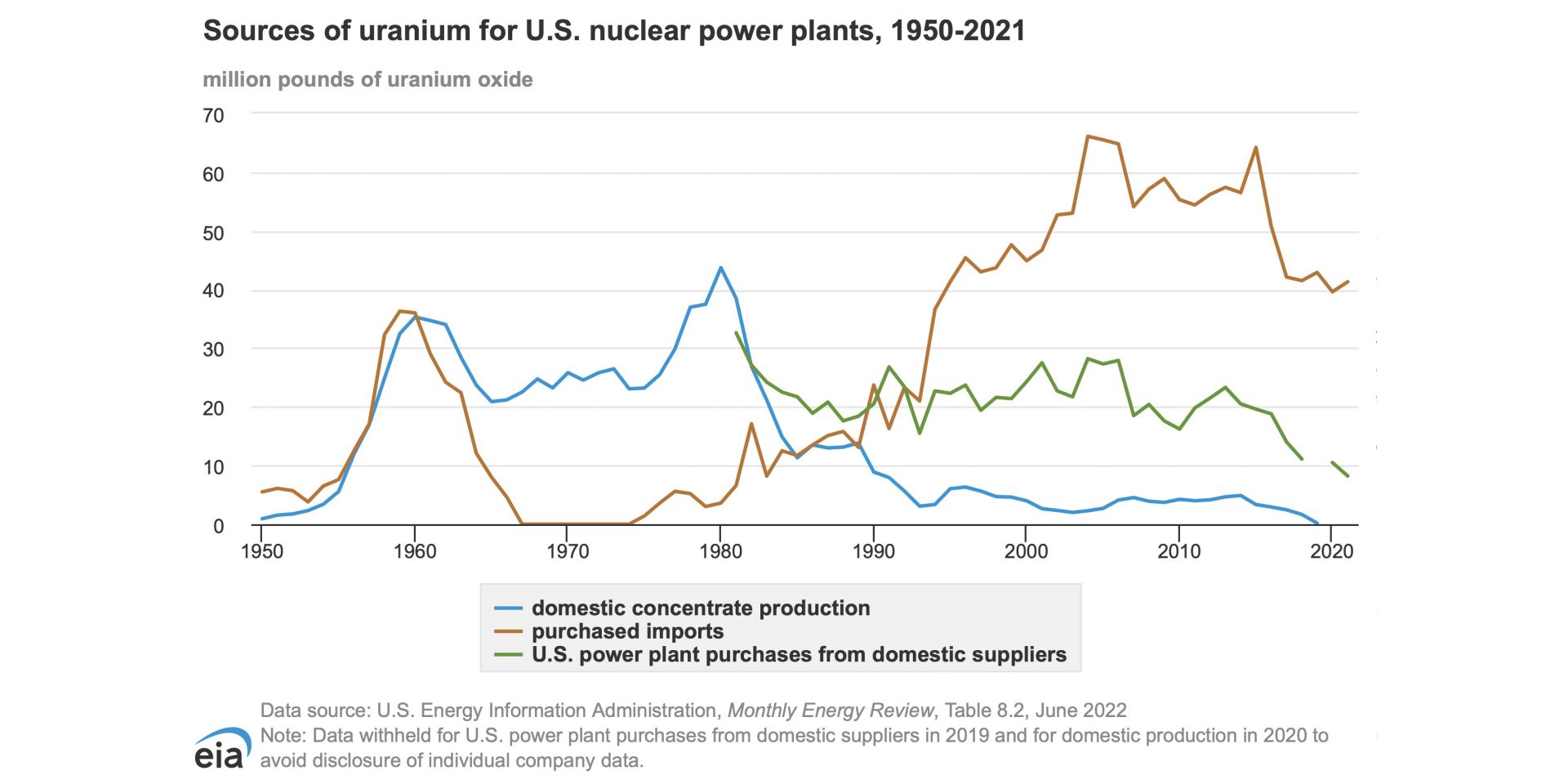

This chart from the EIA shows sources of uranium for U.S. nuclear power plants, 1950-2021. In 2020, according to the chart, 39.60 million pounds of uranium oxide was imported for the domestic nuclear power plant fleet. (Credit: Energy Information Agency)

The naturalist John Muir is widely quoted as saying, “When we try to pick out anything by itself, we find it hitched to everything else in the Universe.” While he was speaking of ecology, he might as well have been talking about nuclear fuel.

At the moment, by most accounts, nuclear fuel is in crisis for a lot of reasons that weave together like a Gordian knot. Today, despite decades of assertions from nuclear energy supporters that the supply of uranium is secure and will last much longer than fossil fuels, the West is in a blind alley. We find ourselves in conflict with Russia with ominous implications for uranium, for which Russia holds about a 14 percent share of the global market, and for two processes that prepare uranium for fabrication into reactor fuel: conversion (for which Russia has a 27 percent share) and enrichment (a 39 percent share).