Framatome’s fuel fabrication facility in Richland, Wash. (Photo: Framatome)

TerraPower announced May 29 that it will work with Framatome North America to fund the high-assay low-enriched uranium (HALEU) metallization pilot plant that Framatome is building at its fuel fabrication facility in Richland, Wash. A successful demonstration of Framatome’s capability of converting enriched uranium oxide to HALEU metal will “support the development of the domestic HALEU supply chain,” both companies say.

Uranium yellowcake is used in the preparation of uranium fuel that is used in nuclear reactors. (Photo: DOE)

On May 13, President Biden signed the Prohibiting Russian Uranium Imports Act, unlocking the $2.72 billion that Congress conditionally appropriated in March to increase production of low-enriched uranium (LEU) and high-assay low-enriched uranium (HALEU).

A rendering the X-energy fuel fabrication facility planned for construction in Oak Ridge, Tenn. (Source: X-energy)

Advanced reactor company X-energy has been awarded $148.5 million in tax credits under the Inflation Reduction Act for construction of its TRISO-X fuel fabrication facility in Oak Ridge, Tenn.

Bulgarian prime minister Dimitar Glavchev, left, and acting energy minister Vladimir Malinov visited Kozloduy nuclear power plant, where Westinghouse is lined up to build two new reactors. (Photo: gov.bg)

Bulgarian officials have approved the transition to Westinghouse fuel at the nation's Kozloduy nuclear power plant, as Bulgaria moves away from its reliance on Russian supplies. The fuel was recently delivered for use in Unit 5.

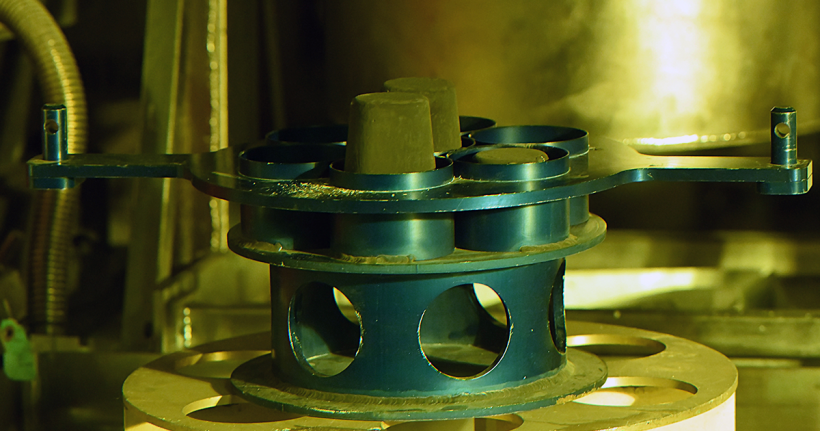

ANEEL fuel experiment capsules being staged at the ATR. (Photo: Clean Core)

Clean Core Thorium Energy (Clean Core) has announced that its ANEEL fuel is ready to begin irradiation testing and qualification at Idaho National Laboratory. The fuel, made of thorium and HALEU, was developed by Clean Core for use in pressurized heavy water reactors, including CANDU (Canadian deuterium-uranium) reactors. Irradiation of the fuel samples in INL’s Advanced Test Reactor (ATR) is set to begin this month.

The extrusion in progress. (Photo: INL/Lightbridge)

Lightbridge Corporation announced today that it has reached “a critical milestone” in the development of its extruded solid fuel technology. Coupon samples using an alloy of zirconium and depleted uranium—not the high-assay low-enriched uranium (HALEU) that Lightbridge plans to use to manufacture its fuel for the commercial market—were extruded at Idaho National Laboratory’s Materials and Fuels Complex.

HALEU reguli fabricated from downblended high-enriched uranium recovered from legacy EBR-II fuel at Idaho National Laboratory. (Image: DOE)

The Department of Energy yesterday announced a draft environmental impact statement (EIS) on HALEU Availability Program plans to purchase high-assay low-enriched uranium under 10-year contracts to seed the development of a sustainable commercial HALEU supply chain.

Urenco UK’s Capenhurst enrichment site, which received a grant in July 2023 to prepare for HALEU enrichment. (Photo: Urenco UK)

The United Kingdom’s Department for Energy Security and Net Zero announced plans on January 7 to invest £300 million (about $383 million) to build a high-assay low-enriched uranium (HALEU) enrichment facility in northwest England. The goal? To “end Russia’s reign as the only commercial producer of HALEU.” Britain is now the first European country to declare that it will begin HALEU enrichment in a bid for supply chain security.

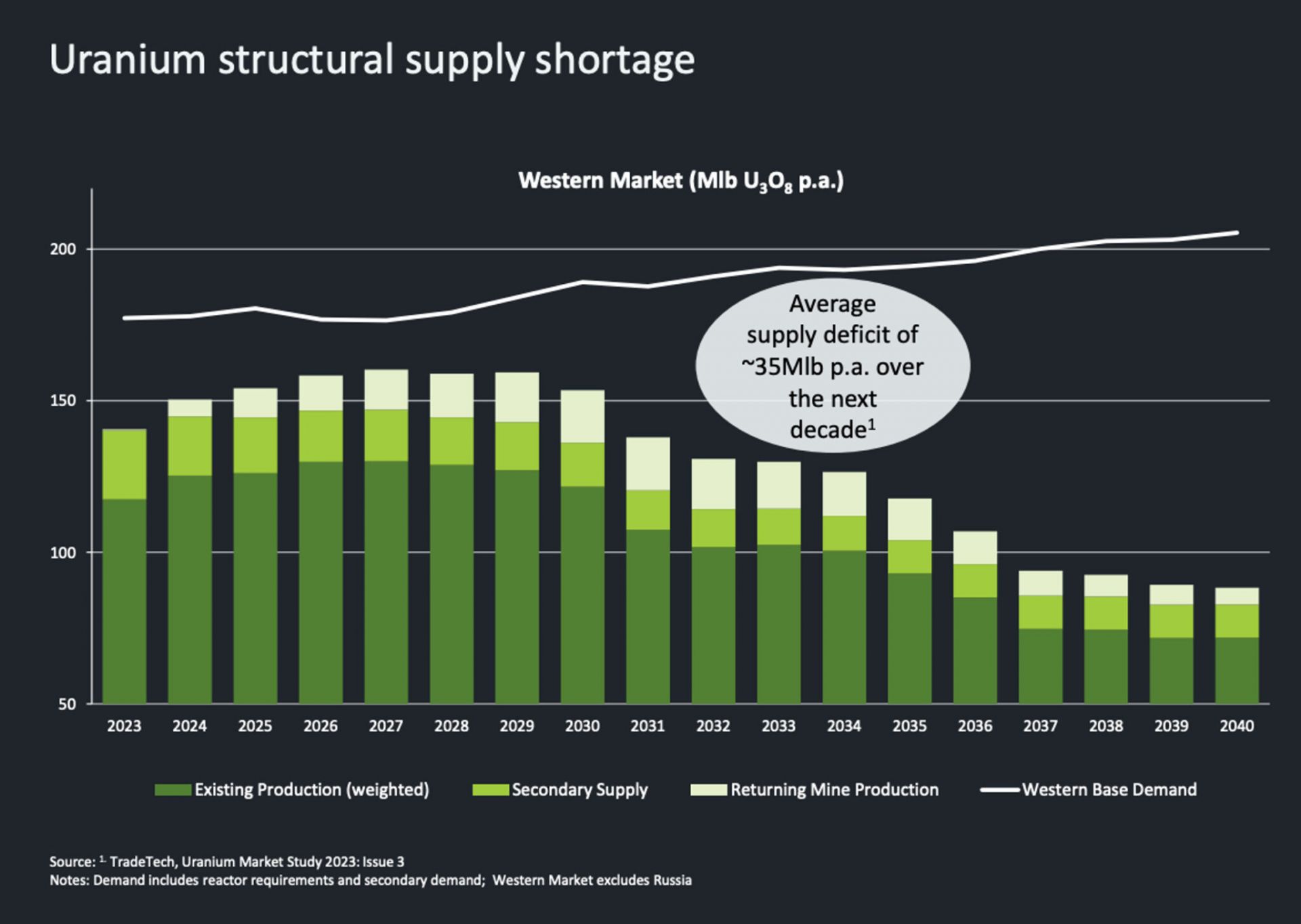

[Click to see full graphic] Western base demand (white line) for uranium will continue to outpace the combined existing production (dark green), secondary supply (middle green), and returning mine production (light green) through 2040, according to projections. (Image: Paladin Energy)

Investors continue to be bullish on uranium, according to a number of recent news reports. Stockhead recently trumpeted, “Uranium has started 2024 the same way it ended 2023—like a bull in a china shop. Spot prices are now agonizingly close to US$100/lb for the first time since 2008, with term pricing not far behind.” Similarly, Mining.com noted, “The spot price of uranium continues to rise, boosted by pledges to triple nuclear power by mid-century, supply hiccups from producers such as Cameco . . . , and the looming threat of a ban on Russian exports to the West.”