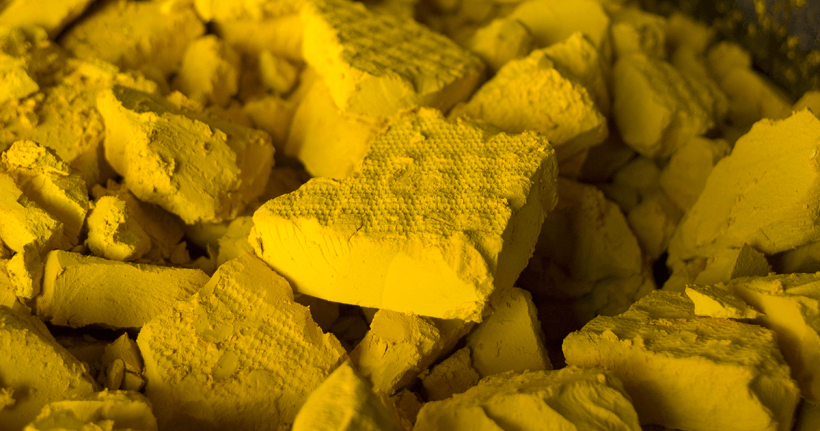

Arizona governor intercedes on uranium transport in Navajo Nation

Energy Fuels has paused transport of uranium ore from its mine south of the Grand Canyon in Arizona to a processing facility in Utah—a path that crosses Navajo Nation land.

Energy Fuels has paused transport of uranium ore from its mine south of the Grand Canyon in Arizona to a processing facility in Utah—a path that crosses Navajo Nation land.

Members of the Navajo Nation are challenging the legality of uranium ore transport from a mine in Arizona across tribal lands to a processing facility in Utah.

A 2012 law bans uranium transport on the vast Navajo Nation land, which covers portions of Arizona, New Mexico, and Utah. Navajo Nation president Buu Nygren issued an executive order on Wednesday saying that there must be an agreement before uranium is transported through the reservation.

A plan to build up a high-assay low-enriched uranium fuel cycle in the United Kingdom to support the deployment of advanced reactors is still in place after the Labour party was voted to power on July 4, bringing 14 years of conservative government to an end. A competitive solicitation for grant funding to build a commercial-scale HALEU deconversion facility opened days before the election, and the support of the new government was confirmed by a set of updates on July 19. But what does the U.K. HALEU program entail, and how does it differ from the U.S. HALEU Availability Program?

BWX Technologies Inc. announced today that its Advanced Technologies subsidiary has signed a cooperation agreement with the state of Wyoming to evaluate locations and requirements for siting a potential new TRISO nuclear fuel fabrication facility in the state.

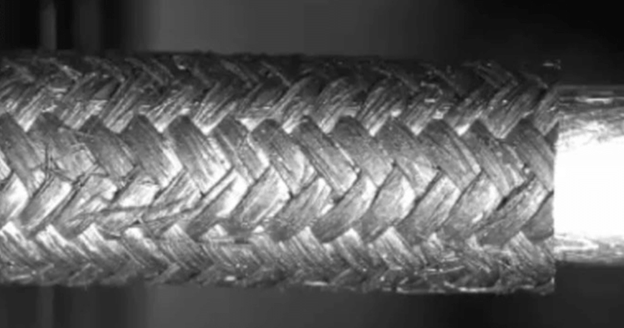

Because of its hardness and its hardiness in the face of high temperatures, silicon carbide has been used for industrial purposes for decades. It has proven its worth as a key component of tiny TRISO fuel particles. But SiC has a weakness—in its pure form it is too brittle for use in structural components, such as 12-foot-long light water reactor fuel cladding tubes.

The Department of Energy released an anticipated request for proposals on June 27 for low-enriched uranium enrichment. “Today’s action will help spur the safe and responsible build-out of uranium enrichment capacity in the United States, promote diversity in the market, and provide a reliable supply of commercial nuclear fuel to support the energy security and resilience of the American people and domestic industries, free from Russian influence,” the DOE declared.

TerraPower announced May 29 that it will work with Framatome North America to fund the high-assay low-enriched uranium (HALEU) metallization pilot plant that Framatome is building at its fuel fabrication facility in Richland, Wash. A successful demonstration of Framatome’s capability of converting enriched uranium oxide to HALEU metal will “support the development of the domestic HALEU supply chain,” both companies say.

Utilities need to know months ahead of a scheduled refueling outage that fresh fuel will be on-site and ready to load. Now that the Prohibiting Russian Uranium Imports Act has been signed into law, U.S. utilities with plans to use Russian-origin low-enriched uranium also need to know if they can secure a waiver for imports through December 31, 2027—subject to specific annual limits—if “no alternative viable source of [LEU] is available to sustain the continued operation of a nuclear reactor or a United States nuclear energy company” or if LEU imports from Russia are “in the national interest.”

On May 13, President Biden signed the Prohibiting Russian Uranium Imports Act, unlocking the $2.72 billion that Congress conditionally appropriated in March to increase production of low-enriched uranium (LEU) and high-assay low-enriched uranium (HALEU).

Shikha Prasad

High-assay low-enriched uranium (HALEU) has emerged as a popular fuel choice for advanced small modular reactors due to its long power production periods before refueling. It is currently being pursued by TerraPower, X-energy, BWX Technologies, Kairos, Oklo, and other reactor companies. HALEU has a uranium-235 enrichment ranging from 5 percent to 20 percent, whereas traditional LWRs use low-enriched uranium fuel enriched up to 5 percent.

HALEU will provide power for longer durations, compared with traditional LWRs. But could it also provide an opportunity for more rapid proliferation, as is speculated in a 2023 National Academy of Sciences report on advanced nuclear reactors (nap.nationalacademies.org/catalog/26630/)?

If a nuclear proliferator conspires to divert fresh nuclear fuel for weapons production when it has not been used in a reactor, the effort required in separative work units (SWUs) to enrich U-235 from 5 percent to 90 percent and that required to enrich from 20 percent to 90 percent are both very small, compared with the effort required to enrich U-235 from its natural abundance to the initial 5 percent.

Ken Petersen

president@ans.org

With all that is happening in the industry these days, the nuclear fuel supply chain is still a hot topic. The Russian assault in Ukraine continues to upend the “where” and “how” of attaining nuclear fuel—and it has also motivated U.S. legislators to act.

Two years into the Russian war with Ukraine, things are different. The Inflation Reduction Act was passed in 2022, authorizing $700 million in funding to support production of high-assay low-enriched uranium in the United States. Meanwhile, the Department of Energy this January issued a $500 million request for proposals to stimulate new HALEU production. The Emergency National Security Supplemental Appropriations Act of 2024 includes $2.7 billion in funding for new uranium enrichment production. This funding was diverted from the Civil Nuclear Credits program and will only be released if there is a ban on importing Russian uranium into the United States—which could happen by the time this column is published, as legislation that bans Russian uranium has passed the House as of this writing and is headed for the Senate. Also being considered is legislation that would sanction Russian uranium. Alternatively, the Biden-Harris administration may choose to ban Russian uranium without legislation in order to obtain access to the $2.7 billion in funding.

The United States has an ambitious goal: to establish a high-assay low enriched-uranium advanced nuclear fuel supply chain, revive the once thriving nuclear fuel market for low-enriched uranium in the nation, and “reestablish U.S. leadership in nuclear energy more broadly.” Making a success of that could have impacts beyond the nuclear sector. According to the Department of Energy’s Office of Nuclear Energy, “Expanding domestic LEU and HALEU enrichment production will be essential for fueling the clean energy required to bring down emissions in all sectors of the economy—including in hard-to-abate sectors such as manufacturing and industrial—while delivering high paying jobs to communities across the country.”

Advanced reactor company X-energy has been awarded $148.5 million in tax credits under the Inflation Reduction Act for construction of its TRISO-X fuel fabrication facility in Oak Ridge, Tenn.

Bulgarian officials have approved the transition to Westinghouse fuel at the nation's Kozloduy nuclear power plant, as Bulgaria moves away from its reliance on Russian supplies. The fuel was recently delivered for use in Unit 5.

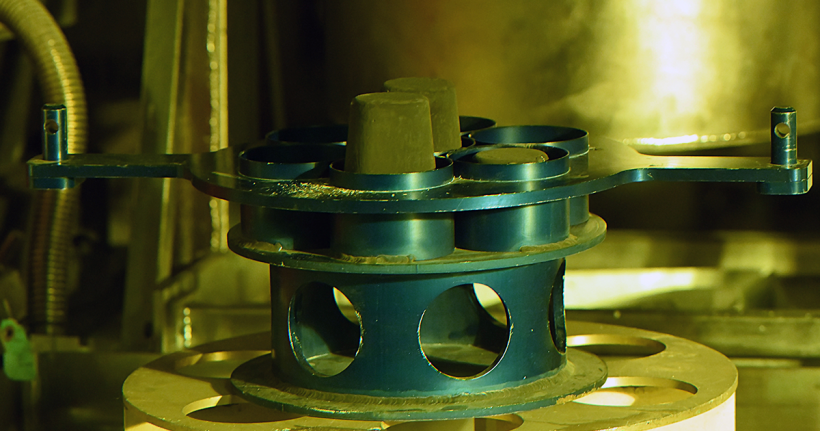

Clean Core Thorium Energy (Clean Core) has announced that its ANEEL fuel is ready to begin irradiation testing and qualification at Idaho National Laboratory. The fuel, made of thorium and HALEU, was developed by Clean Core for use in pressurized heavy water reactors, including CANDU (Canadian deuterium-uranium) reactors. Irradiation of the fuel samples in INL’s Advanced Test Reactor (ATR) is set to begin this month.

Let’s face it: The global economy should be powered primarily by nuclear power. And it probably will by the end of this century, with a still-significant assist from renewables and hydro. Once nuclear systems are dominant, the costs come down to where gas is now; and when carbon emissions are reduced to a small portion of their present state, it will become obvious that most other sources are only good in niche settings. I mean, why use small modular reactors to load-follow when they can just produce that power instead of buffering it?

On March 26, Silex Systems Ltd. announced that Global Laser Enrichment’s test loop pilot demonstration facility and operational safety programs have been reviewed by the Nuclear Regulatory Commission and approved for loading uranium hexafluoride feed material in preparation for the next phase of GLE’s enrichment technology demonstration in the second quarter of 2024.

Lightbridge Corporation announced today that it has reached “a critical milestone” in the development of its extruded solid fuel technology. Coupon samples using an alloy of zirconium and depleted uranium—not the high-assay low-enriched uranium (HALEU) that Lightbridge plans to use to manufacture its fuel for the commercial market—were extruded at Idaho National Laboratory’s Materials and Fuels Complex.

The Department of Energy yesterday announced a draft environmental impact statement (EIS) on HALEU Availability Program plans to purchase high-assay low-enriched uranium under 10-year contracts to seed the development of a sustainable commercial HALEU supply chain.

GE Vernova, which leads Global Nuclear Fuel (GNF) with partner Hitachi, announced February 14 that GNF has received approval from the Nuclear Regulatory Commission to manufacture, ship, and analyze the performance of nuclear fuel enriched with up to 8 percent uranium-235.